40 us treasury coupon rate

How does the U.S. Treasury decide what coupon rate to ... Answer (1 of 3): The coupon is usually set close to yield within typical rates i.e. 1/16th or 1/32 to generate a near par price. Trading too far away from par will either raise less money or reduce the appetite for investors if it is purchased way above par. The new issue or on-the-run can also ... › 1-year-treasury-rate › table1 Year Treasury Rate by Month - multpl.com Dec 01, 2021 · 1 Year Treasury Rate table by month, historic, and current data. Current 1 Year Treasury Rate is 1.96%, a change of -3.00 bps from previous market close. S&P 500 PE Ratio

United States Government Bond 10Y - 2022 Data - 1912-2021 ... The yield on the 10-year US Treasury note, which sets the tone for corporate and household borrowing costs worldwide, bottomed around 2.95% as investors took a breather after a recent selloff. The yield hit 3.20% on Monday for the first time since November 2018, with the market pricing in the chances of an increasingly hawkish Federal Reserve stance to fight high inflation.

Us treasury coupon rate

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Important Differences Between Coupon and Yield to Maturity Coupon vs. Yield to Maturity . A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon.For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ...

Us treasury coupon rate. MarketWatch: Stock Market News - Financial News - MarketWatch MarketWatch: Stock Market News - Financial News - MarketWatch US Treasury Zero-Coupon Yield Curve US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,282 datasets) Refreshed 2 hours ago, on 16 May 2022 Frequency daily Description These yield curves... Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) Graph and download economic data for Fitted Yield on a 10 Year Zero Coupon Bond (THREEFY10) from 1990-01-02 to 2022-05-06 about 10-year, bonds, yield, interest rate, interest, rate, and USA. Are most US treasury bonds which pay coupons of fixed ... Answer (1 of 5): Yes, most conventional Treasury bonds are issued with a coupon that is fixed for the life of the bond. For example, a 3% coupon bond will pay $15 in interest every 6 months—$30 per year on a bond with $1000 face value— no matter what. But there are exceptions: * Bonds that ma...

US Treasury Bonds Rates - Yahoo Finance 13 Week Treasury Bill 0.9050 +0.0220 +2.49% Ultra 10-Year U.S. Treasury Note Options Quotes - CME Group Ultra 10-Year U.S. Treasury Note Options - Quotes. Last Updated 21 Apr 2022 07:30:43 PM CT. Market data is delayed by at least 10 minutes. All market data contained within the CME Group website should be considered as a reference only and should not be used as validation against, nor as a complement to, real-time market data feeds. home.treasury.gov › newsPress Releases | U.S. Department of the Treasury The Committee on Foreign Investment in the United States (CFIUS) Exchange Stabilization Fund. G-7 and G-20. International Monetary Fund. Multilateral Development Banks. Macroeconomic and Foreign Exchange Policies of Major Trading Partners. Exchange Rate Analysis. U.S.-China Comprehensive Strategic Economic Dialogue (CED) Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond... Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The... Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) Interest Rates - United States Secretary of the Treasury The "Daily Treasury Long-Term Rates" are simply the arithmetic average of the daily closing bid yields on all outstanding fixed coupon bonds (i.e., inflation-indexed bonds are excluded) that are neither due nor callable for at least 10 years as of the date calculated.

The Fed - H.15 - Selected Interest Rates (Daily) - May 13 ... The 30-year Treasury constant maturity series was discontinued on February 18, 2002, and reintroduced on February 9, 2006. From February 18, 2002, to February 9, 2006, the U.S. Treasury published a factor for adjusting the daily nominal 20-year constant maturity in order to estimate a 30-year nominal rate.

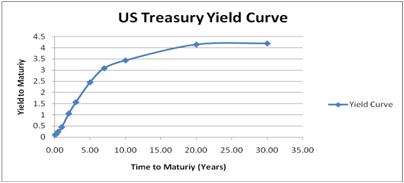

10-Year Treasury Note Definition - Investopedia Below is a chart of the 10-year Treasury yield from March 2019 to March 2020. Over that span, the yield steadily declined with expectations that the Federal Reserve would maintain low interest...

› markets › rates-bondsUnited States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EDT) GB3:GOV . 3 Month ...

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

corporatefinanceinstitute.com › resourcesTreasury Bills - Guide to Understanding How T-Bills Work For example, a Treasury bill with a par value of $10,000 may be sold for $9,500. The US Government, through the Department of Treasury, promises to pay the investor the full face value of the T-bill at its specified maturity date. Upon maturity, the government will pay the investor $10,000, resulting in a profit of $500.

› govt › ratesGovernment - Continued Treasury Zero Coupon Spot Rates* 3.20. 3.38. 3.79. *Four quarters covering calendar year 2012 and the first and second quarters of calendar year 2013 prepared by Economic Policy (EP) using the Office of the Comptroller of the Currency (OCC) legacy model. Legacy model quarterly rates can be viewed within the "Selected Asset and Liability Price Report" under "Spot (Zero ...

20 Year Treasury Rate - YCharts The 20 year treasury yield is included on the longer end of the yield curve. The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.32%, compared to 3.22% the previous market day and 2.28% last year.

Treasury Coupon Bonds - Economy Watch The most important advantage of treasury coupon bonds is that they let you create a stable source of income during a given year. The coupon rate can vary depending upon the structure of the bonds. Some negotiable bond types come with fixed interest rates while others come with variable coupon rates based on the floating interest rate. [br]

XYZ US Treasury Coupon rate 6 semi annual coupon 4 semi ... xyz u.s. treasury coupon rate 6% semi-annual coupon 4% semi-annual coupon time to maturity 19 years (7.25% ytm) 20 years (4.0% ytm) 18 years (3.6% ytm) yield curve 4.0% flat because the maturity of the xyz bond does not match exactly with the maturity of the quoted treasury bonds, the i-spread will be computed as: i-spread = 7.25% − (4.0% + 3.6%) …

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992 TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997

Remarks by Climate Counselor John Morton at the MSCI ... Remarks As prepared for Delivery. Thank you, Henry, for that introduction. MSCI has been a leader in developing the data and information that investors need to assess climate-related risks and opportunities, and the theme of this event - Capital for Climate Action - is very timely. In recent weeks, the global effort to keep a 1.5-degree warming limit within reach has faced a new headwind ...

US20Y: U.S. 20 Year Treasury - Stock Price, Quote ... - CNBC Yield Open 3.091% Yield Day High 3.214% Yield Day Low 3.09% Yield Prev Close 3.126% Price 87.9062 Price Change -1.0625 Price Change % -1.1953% Price Prev Close 88.9688 Price Day High 89.4688 Price...

home.treasury.gov › system › filesThe Treasury Breakeven Inflation Curve The HQM spot rate is 4.58 percent at 30 years maturity, compared to 3.16 percent and 1.22 percent for the TNC and TRC spot rates, respectively. The TBI rate is 1.95 percent at 30 years maturity. The HQM rate exceeds the TNC rate largely because of corporate bond default risk, and the TNC rate exceeds the TRC rate with positive inflation.

corporatefinanceinstitute.com › resources10-Year US Treasury Note - Guide, Examples, Importance of 10 ... Treasury notes are issued for a term not exceeding 10 years. The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market.

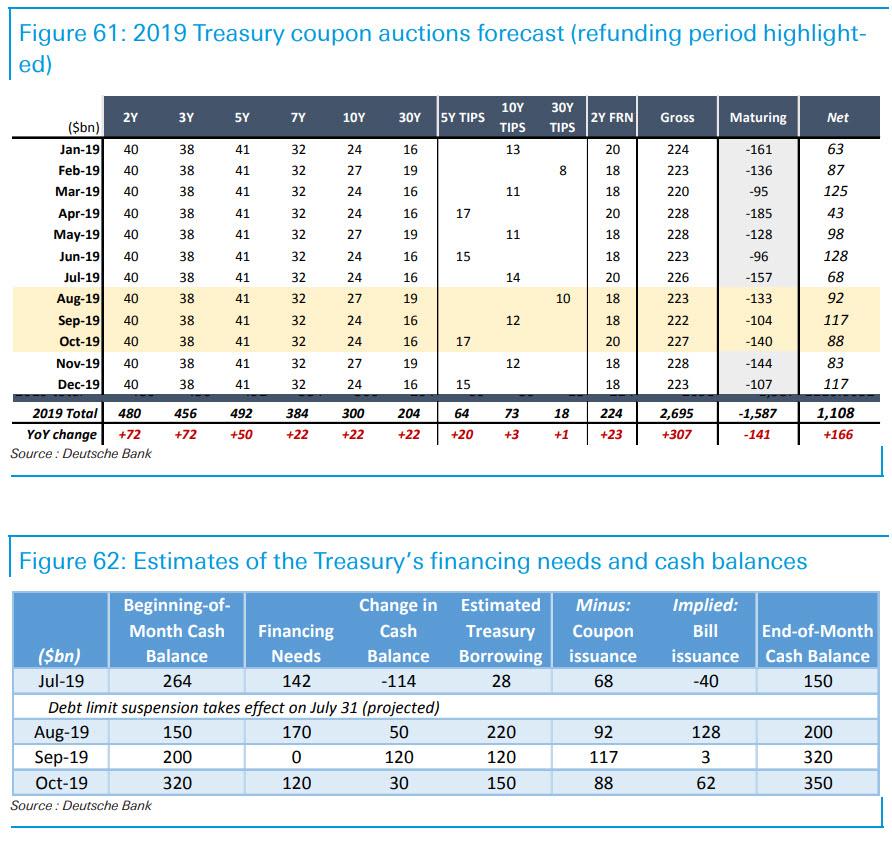

U.S. Treasury Bond Futures Quotes - CME Group Gain an in-depth view into the US Treasury market, including yields, volatility, auctions, coupon issuance projections, and more. STIR Analytics View historical fixings for EFFR and SOFR, and analyze basis spreads between Eurodollar, Fed Fund, and SOFR futures.

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ...

Post a Comment for "40 us treasury coupon rate"