44 coupon rate on bonds

Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ... Coupon Rate To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

What is 'Coupon Rate' The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market.

Coupon rate on bonds

What Is a Coupon Rate? The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity... Difference Between Coupon Rate and Interest Rate (With Table) Coupon Rate: Interest Rate: Meaning: A coupon rate is an annual interest payment received by the bondholder on the bonds after the maturity period comes to an end. Coupon rates are issued on fixed-income security such as bonds, mortgage, securities etc. Interest rate is charged to the borrower by the lender in case of any borrowing or lease ... Coupon Rate The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon rate on bonds. What Is Coupon Rate of A Bond A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. Coupon Rate Structure of Bonds - Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years. Why a reduction in coupon rate of tax-free bonds? May 03, 10:05. You may end up with getting lower coupon rate than specified if your investment exceeds ₹10 lakh in certain tax-free bonds. The benefit of higher interest rates in these bonds is ... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

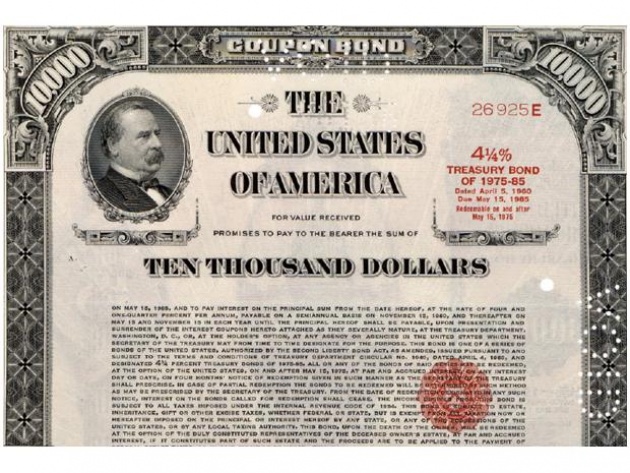

Coupon rate - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Individual - TreasuryDirect Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) Coupon Bond - Corporate Finance Institute Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Zero-coupon bond Zero coupon bonds have a duration equal to the bond's time to maturity, which makes them sensitive to any changes in the interest rates. Investment banks or dealers may separate coupons from the principal of coupon bonds, which is known as the residue, so that different investors may receive the principal and each of the coupon payments. What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Coupon Rate Calculator The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Coupon Rate Formula - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

Coupon Rate The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

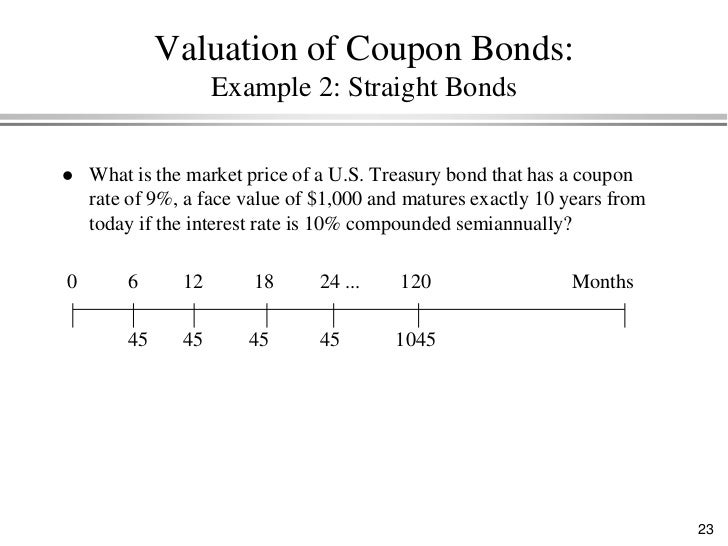

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. In our example above, the $1,000 pays a 10% interest rate on its coupon. Investors use the phrase coupon rate for two reasons. First, a bond's interest rate can often be confused for its yield rate, which we'll get to in a moment.

Meaning - My Accounting Course The rate pays 8% annually. The coupon's current yield is 5.22%, and the yield to maturity is 3.85%. What is the coupon payment Georgia will receive? The coupon payment on each bond is $1,000 x 8% = $80. So, Georgia will receive $80 interest payment as a bondholder.

Bonds A and B have 3-year maturity. Bond A has coupon rate ... Bonds A and B have 3-year maturity. Bond A has coupon rate 2% and. trades at $985,76. Bond B has coupon rate 4% and trades at $1,042.92. A zero-coupon. bond with 1-year maturity trades at 977.52. All bonds have a face value of $1,000. (a) [10 marks] Compute the one-year spot rate. Compute the two- and three-year. rates under the assumption that ...

High Yield Bonds - Fidelity Investments High Yield Bonds High yield (non-investment grade) bonds are from issuers that are considered to be at greater risk of not paying interest and/or returning principal at maturity.As a result, the issuer will generally offer a higher yield than a similar bond of a higher credit rating and, typically, a higher coupon rate to entice investors to take on the added risk.

Floating Rate Bonds: Characteristics, Rate ... - CFAJournal Fixed-rate bonds lose the charm for investors when interest rates rise, as the investors can purchase another bond with higher coupon rates. Floating-rate bonds eliminate that factor of uncertainty for investors. As the coupon payments adjust with interest rate changes, the investors are less exposed to the opportunity cost. ...

United States Rates & Bonds - Bloomberg.com Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. Markets ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 102.65- ...

Post a Comment for "44 coupon rate on bonds"