40 coupon rate of bond

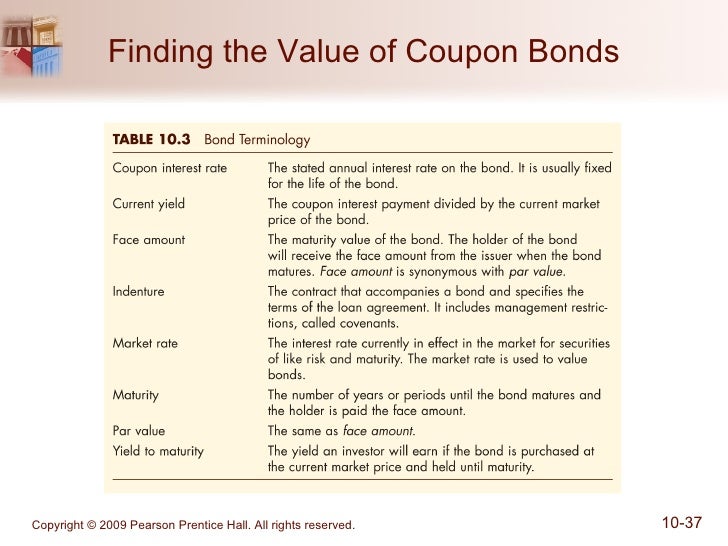

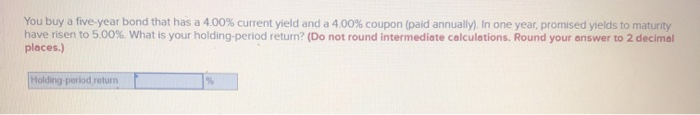

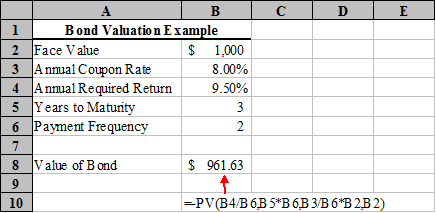

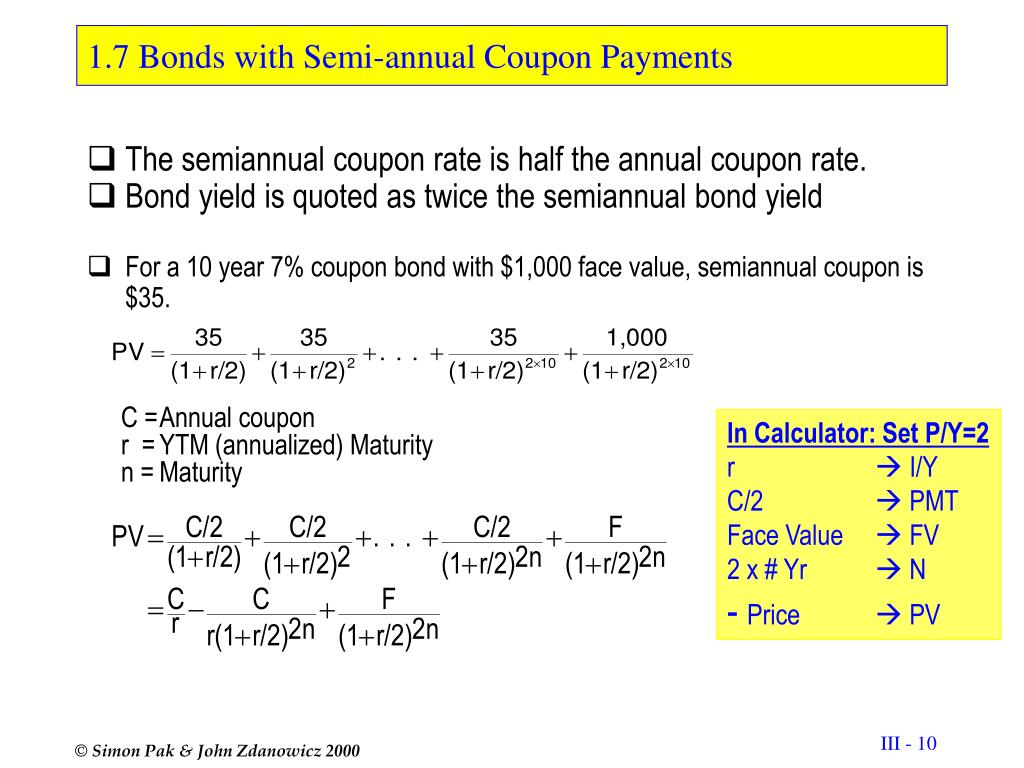

Coupon Rate | Investor.gov Glossary Coupon Rate The interest rate on a bond. It is expressed as a semi-annual rate. What is a Coupon Rate? - Definition | Meaning | Example Other bonds may pay interest every three months. In order to calculate the coupon rate formula of a bond, we need to know: the face value of the bond, the annual coupon rate, and the number of periods per annum. Let's look at an example. Example. The coupon payment on each bond is $1,000 x 8% = $80.

Coupon Rate Structure of Bonds — Valuation Academy 1) Fixed Rate Bonds have a constant coupon rate throughout the life of the bond. For example: a Treasury bond with face amount (or principal amount) $1000 that has a 4% coupon and matures 6 years from now, the U.S. Treasury has to pay 4% of the par value ($40) each year for 6 years and the par value ($1000) at the end of 6 years.

Coupon rate of bond

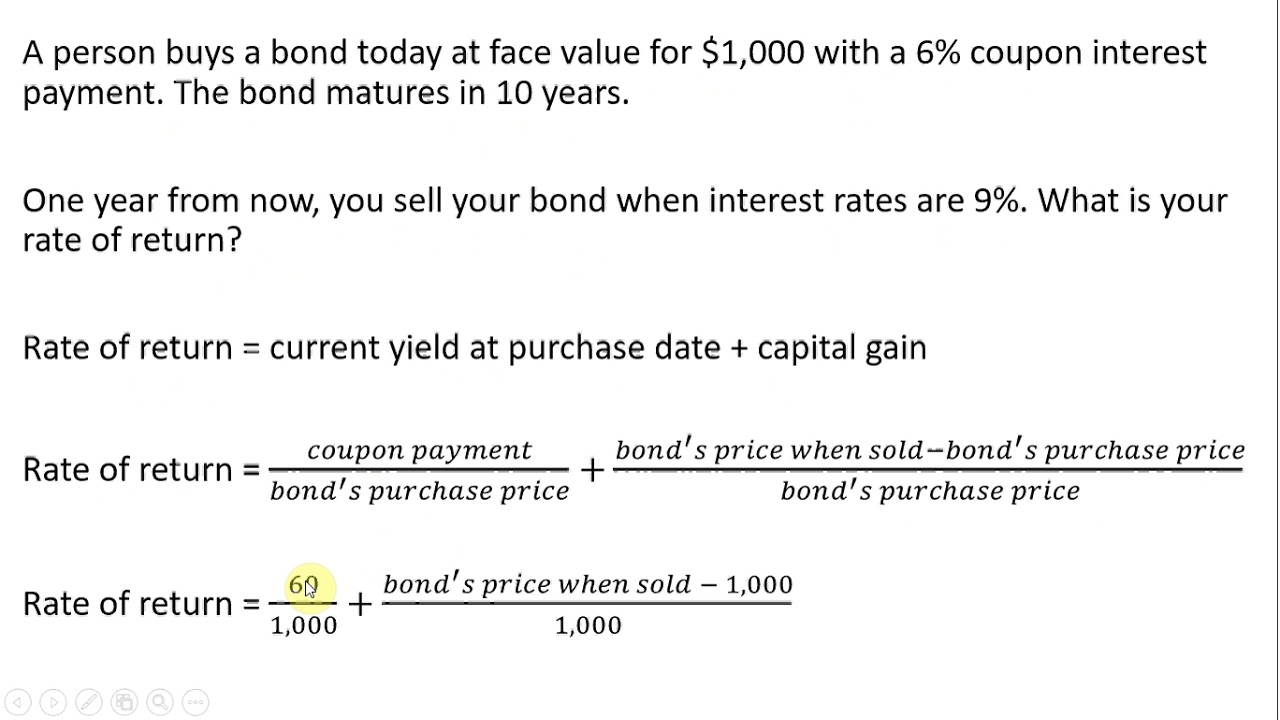

When is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. › ask › answersWhen is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · The annual coupon rate for IBM bond is therefore equal to $20 ÷ $1000 = 2%. The coupons are fixed; no matter what price the bond trades for, the interest payments always equal $20 per year.

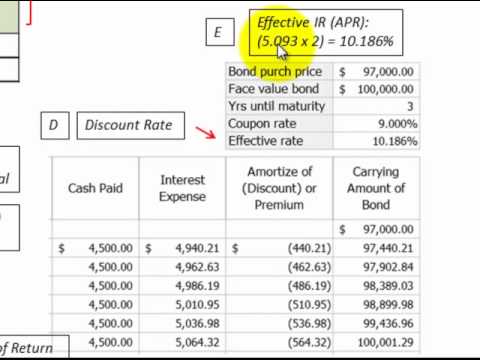

Coupon rate of bond. Coupon Bond | Coupon Bond Price | Examples of Coupon Bond Example #1. Let us take the example of a debt raised by ASD Inc. in the form of a bond that pays coupons annually. The par value of the bond is $1,000, coupon rate is 5% and number of years until maturity is 10 years. Determine the price of the CB if the yield to maturity is 4%. Popular Course in this category. How to Calculate Bond Discount Rate: 14 Steps (with Pictures) Jan 12, 2020 · A bond discount is the difference between the face value of a bond and the price for which it sells. The face value, or par value, of a bond is the principal due when the bond matures. Bonds are sold at a discount when the market interest rate exceeds the coupon rate of the bond. In order to calculate how the amount of the bond discount, you ... Coupon Rate of a Bond - Harbourfront Technologies Based on these steps, the formula to calculate the coupon rate of a bond is as follows. Coupon Rate of a Bond = Total Annual Coupon Payment / Par Value of Bond x 100%. For example, a bond offers a total annual coupon payment of $50. The bond 's par value is $1,000. Therefore, its coupon rate will be 5% ($50 / $1,000 x 100). How to Find Coupon Rate of a Bond on Financial Calculator How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year.

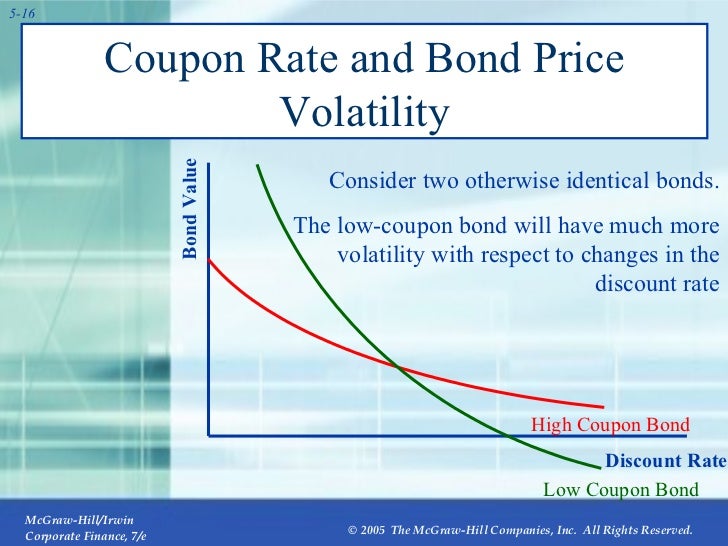

22 a bond issued with a very low coupon rate as 2. With floor-and-ceiling provisions the coupon rate is subject to a minimum and maximum. For example, the minimum coupon rate might be 8 percent and the maximum rate might be 14 percent. The popularity of floating-rate bonds is connected to inflation risk. When inflation is higher than expected, issuers of fixed-rate bonds tend to make gains at the expense of lenders, and when inflation is ... › what-is-a-bond-coupon-and-howWhat Is a Bond Coupon? - The Balance Mar 04, 2021 · "Bond coupons" is a term that's used to refer to physical coupons. These coupons could be redeemed for cash. The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest ... Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

› bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Suppose in the above example, the market discount rate increases to 10%, then the bond price would be given as follows: n = 3 i = 10% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 3 Zero coupon bond price = 751.31 (rounded to 751)

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping Jul 16, 2019 · Suppose in the above example, the market discount rate increases to 10%, then the bond price would be given as follows: n = 3 i = 10% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 3 Zero coupon bond price = 751.31 (rounded to 751)

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Coupon Rate Bond - The Strategic CFO™ Bond coupon rates are quoted as annual rates, but the bond coupons are typically paid semi-annually. For example, an investor holding a bond with a $1,000 face value and a 10% annual bond coupon will receive $100 in interest yearly until the bond matures.

Coupon Types - Financial Edge Training With a fixed-rate bond such as a 10-year, 3% coupon annual bond, the investor knows exactly what interest payments will be received every year until maturity. This is assuming that the bond issuer does not default at any point in time. There is a special type of fixed-rate bond called a zero-coupon bond.

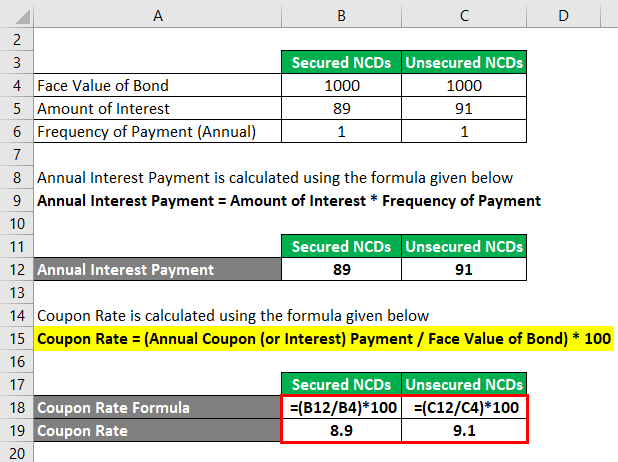

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

› terms › cCoupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Coupon Rate - Meaning, Calculation and Importance - Scripbox Coupon rates are a percentage of the bond's face value (par value) and are set while issuing the bond. Moreover, the coupon payments are fixed for a bond throughout its tenure. Coupon Rate = (Total Annual Interest Payments / Face Value of the Bond) * 100 Let's understand couponrate calculation with the help of an example.

WHAT IS COUPON RATE OF A BOND - The Fixed Income A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment. A point ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing | Wall Street ... The coupon rate is the interest that a bond pays when it is issued. For example, a $100,000 bond with a coupon rate of 2.5% will pay $2500 per year. The interest is usually split into several payments throughout the year. Everything You Need To Master Excel Modeling To Help You Thrive in the Most Prestigious Jobs on Wall Street. Learn More

Coupon Bond - Investopedia Mar 31, 2020 · Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

Coupon Rate Calculator | Bond Coupon Jan 12, 2022 · For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued.. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same. Hence, a higher coupon rate bond, …

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of …

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

Post a Comment for "40 coupon rate of bond"