39 zero coupon bond benefits

Advantages and Risks of Zero Coupon Treasury Bonds 31/01/2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive ... ZROZ News Today | Why did PIMCO 25+ Year Zero Coupon U.S. Treasury ... PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund - ZROZ News Today $101.99 -2.53 (-2.42%) (As of 09/1/2022 09:30 AM ET) Today's Range $101.99 $101.99 50-Day Range $102.90 $114.13 52-Week Range $99.57 $163.61 Volume 95 shs Average Volume 162,783 shs Market Capitalization $450.80 million P/E Ratio N/A Dividend Yield 2.29%

Features and Advantages of Treasury Bills | Invest in T-Bills - Investmentz Zero-coupon securities - T-bills provide no interest on the total investments. Treasury bill investor earns the capital gains instead. An individual can buy the bill at the discounted rate and earn the face value rate upon maturity. Advantages: No risk involved - T-bills are issued by RBI and are supported by the Government of India.

Zero coupon bond benefits

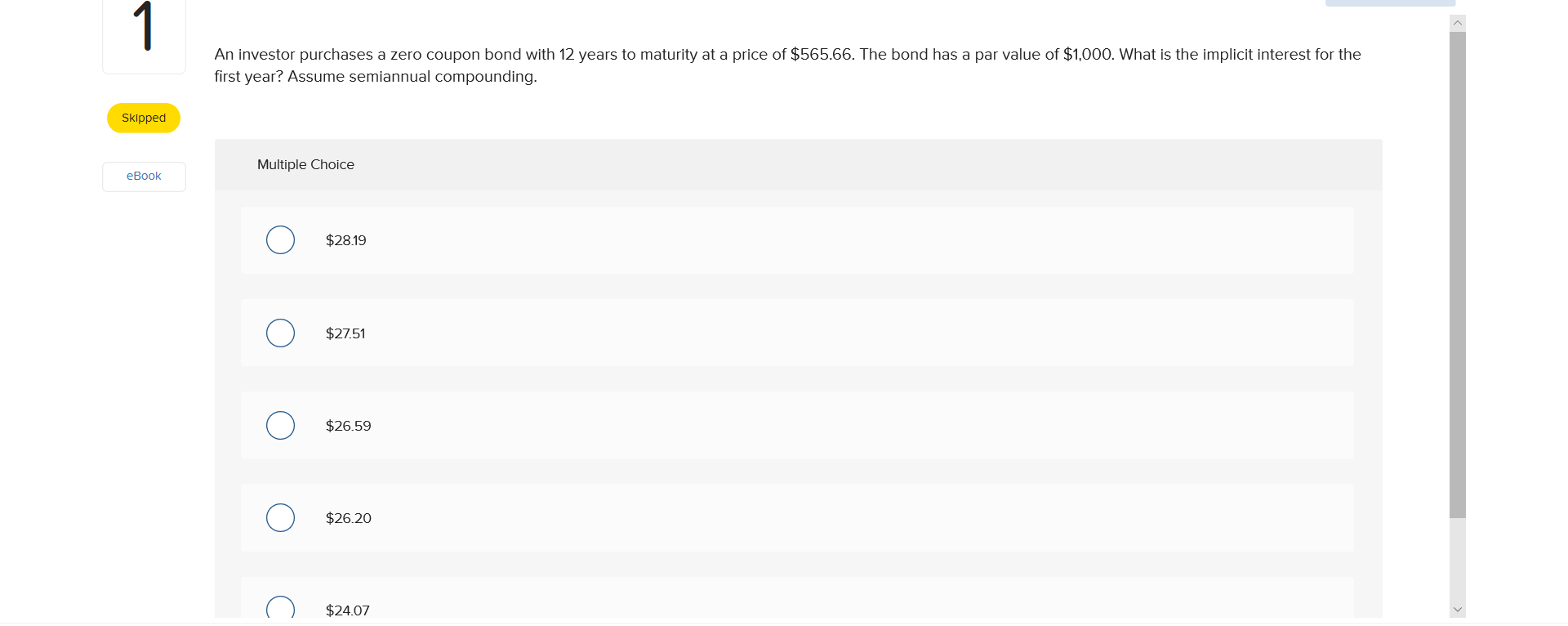

MC Explains | What is a 'zero-coupon, zero-principal' instrument? 20/07/2022 · With its zero-coupon, zero-principal structure, it resembles a debt security like a bond. When an entity takes a loan by issuing regular debt security like a bond, it has to make interest payments ... › government-bondsGovernment Bonds: Types, Benefits & How to Buy ... - BondsIndia Zero Coupon Bonds As the name suggests, Zero Coupon Bonds earns zero interest i.e., no interest. The income generated from Zero-coupon bonds accrues from the difference in the issuance price at a discount and redemption value at par. These bonds are created from existing securities rather than issuing them through auction. Bond Yield to Maturity Calculator for Comparing Bonds The Coupon – This is simply the interest rate on the bond. It is called a ‘coupon', because originally there would be a paper coupon attached to the bond that the owner would tear off and redeem for their interest payments. Of course, these days most interest payments are tracked, and paid, electronically. Still, the term persists. The coupon is expressed as a percentage of …

Zero coupon bond benefits. Pakistan Government Bonds - Yields Curve The Pakistan 10Y Government Bond has a 12.916% yield. Central Bank Rate is 15.00% (last modification in July 2022). The Pakistan credit rating is B-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is 505.92 and implied probability of default is 8.43%. What Is the Face Value of a Bond? - SmartAsset 15/01/2020 · A bond’s coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond’s face value on its maturity date. Ecl Finance Limited N.A.% - Bond - ICICI Direct Zero Coupon. OTHER BONDS ISSUED BY COMPANY. Bonds issued by company Yield (%) Last Traded Price Face Value Time till maturity Last traded on; ECL Finance Ltd 9.95% CRISIL AA/Stable: 10.47: ... Features and Benefits of Demat Account; How to Open Demat Account; Coupon Travelers 40 papa johns coupon retailmenot 50% off papa john's coupon, promo codes - aug. 2022 - giving assistant online code for 40% off your papajohns orders promotional code for 50% off your orders receive 25% off your regular-menu priced purchase expired codes and offers $11 jack-o_lantern verified shaq-a-roni pizza $12 any large, any toppin

What Are Bond Funds? - fool.com A bond fund is an investment vehicle that pools capital from multiple investors to buy a portfolio of bonds or other debt instruments. Bond funds are often a more efficient way for individual... › calcs › bondsBond Yield to Maturity Calculator for Comparing Bonds Let's say you buy a 10 year $1000 bond with a 5% coupon. You hold that bond for the next few years collecting your $50 of annual interest. During that time, interest rates fall, and a comparable 10 year $1000 bond now carries a 4% coupon. Your original bond is now a much more valuable commodity, and it can be sold at a premium on the open market. Treasury Bills by Government of India Treasury bills are zero coupon bonds/ money market securities, are short term debt instruments issued by the Government of India, it pays no interest. It is a debt instrument in which an investor... › terms › cConvertible Bond Definition - Investopedia Oct 06, 2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

What does it mean if a bond has a zero coupon rate? - Investopedia A zero coupon bond generally has a reduced market price relative to its par value because the purchaser must maintain ownership of the bond until maturity to turn a profit. A bond that sells for... How to Give Bonds as a Gift - Investopedia The beauty of savings bonds is that by being backed by the U.S. Treasury, they are guaranteed to be honored. They're also really easy to gift and affordable. With corporate bonds, you typically... Shriram Transport Finance Company Limited N.A.% - Bond - ICICI Direct Zero Coupon. OTHER BONDS ISSUED BY COMPANY. Bonds issued by company Yield (%) Last Traded Price Face Value Time till maturity Last traded on; Shriram Transport Finance Company Ltd 9.5% CRISIL AA+-930000.0: ... Features and Benefits of Demat Account; How to Open Demat Account; One Choice 2030 Portfolio | American Century Investments One Choice ® 2030 Portfolio - ARCVX. One Choice. ®. 2030 Portfolio. Buy Now. SUMMARY PERFORMANCE COMPOSITION MANAGEMENT. $11.72 | 0.59% ($0.07) NAV as of 08/31/2022. Historical NAV.

A 20-year review of Ghana's public debt: Trends, drivers and ... The highest coupon on any issuance was 10.75 per cent in 2015. Coupons have generally hovered around the 8.5 - 9.0 per cent handle with a few outliers. Then, of course, a much-touted zero-coupon bond was issued in March 2021, but this did not necessarily come cheap if you factor in the 22 per cent discount applied.

› articles › investingAdvantages and Risks of Zero Coupon Treasury Bonds - Investopedia Jan 31, 2022 · A zero-coupon bond is a debt security that doesn't pay interest but trades at a deep discount, rendering profit at maturity when it is redeemed. ... The Benefits and Risks of Being a Bondholder.

Convertible Bond Definition - Investopedia 06/10/2020 · Convertible Bond: A convertible bond is a type of debt security that can be converted into a predetermined amount of the underlying company's equity at certain times during the bond's life ...

› news › businessMC Explains | What is a 'zero-coupon, zero-principal' instrument? Jul 20, 2022 · With its zero-coupon, zero-principal structure, it resembles a debt security like a bond. When an entity takes a loan by issuing regular debt security like a bond, it has to make interest payments ...

About Traded on CM - NSE India They are zero coupon short-term bonds; They have maturity less than a year of 91 days, 182 days & 364 days ... SDLs are generally fixed maturity and fixed coupon securities carrying half yearly coupon paying bonds; Largely issued in the range of 3-35 year maturities; Redeemed at face value on maturity; Benefits of Investing in Government Bond ...

Mendus AB: Mendus announces financing commitments totaling up to SEK ... The convertible bonds carry a zero coupon and will be issued at a subscription price corresponding to their par value. The conversion price will be determined as 92% of the second lowest closing volume weighted average share price (VWAP) of the 10 consecutive trading days preceding the issuance of conversion request by Negma.

Email Me My Coupons Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Fideuram Fund Zero Coupon 2037 - Financial Times Fideuram Fund Zero Coupon 2037 + Add to watchlist. LU0281295724:EUR. Fideuram Fund Zero Coupon 2037. Actions ...

iShares 0-5 Year Investment Grade Corporate Bond ETF | SLQD Asset Class Fixed Income. Benchmark Index Markit iBoxx USD Liquid Investment Grade 0-5 Index. Bloomberg Index Ticker IBXXSIG1. Shares Outstanding as of Aug 31, 2022 62,200,000. Distribution Frequency Monthly. Premium/Discount as of Aug 31, 2022 -0.11. CUSIP 46434V100. Closing Price as of Aug 31, 2022 48.34. 30 Day Avg. Volume as of Aug 31, 2022 ...

Bonds & Rates - WSJ News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services.

14 Best CD Rates for August 2022 - NerdWallet Best CD rates for August 2022. Barclays: 2.50% - 3.25% APY, 1 - 5 years, no minimum to open. Discover Bank: 0.50% - 3.25% APY, 3 months - 10 years, $2,500 minimum to open. Marcus by Goldman Sachs ...

How Bond Maturity Works - US News & World Report 12/03/2020 · Issuers may want to redeem the bond early if interest rates change in a way that benefits them. A callable bond may have a stated maturity of 30 years, but the issuer may have the opportunity to ...

Coupon007 what is the benefit of a zero coupon bond; when do hobby lobby coupons end; when does hobby lobby coupon end; when does hobby lobby stop coupon; where can i get a 20 off coupon for harbor freight; where do you enter coupon code dillards; where do you enter coupon code on rock auto; where do you enter coupon code on rockauto

Bond Markert & Alternative Investment Ruls.ppt Corporate Finance 3-0 © Professor Ho-Mou Wu Bond Market and Alternative Investment Rules 3.1 Valuation of Bonds 3.2 The Term Structure of Interest Rates 3.3 Al…

en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce the interest rate that must be offered in order to sell the bond issue. Example. Price paid for bond with warrants ; Coupon payments C; Maturity T; Required rate of return r; Face value of bond F

Issue Descriptor - Debt Private Placement - NSE India Certificate of Deposit. CD. Floating Rate Bond. BF. Zero Coupon Bonds. BZ. Perpetual Bond. BP. Perpetual Debt Instruments (Additional Tier 1 Instrument)

Bonds | Financial Markets Authority Zero-coupon bond: Doesn't pay interest (a coupon) like other bonds. Instead, you will receive a discount when you purchase the bond and hope you make a profit when the bond is redeemed at maturity. Zero-coupon bonds tend to go up and down in price a lot more than regular coupon bonds. Understanding returns.

/five_thousand_dollar_series_i_savings_bond-56a091263df78cafdaa2cb4c.gif)

Post a Comment for "39 zero coupon bond benefits"