40 what does coupon rate mean

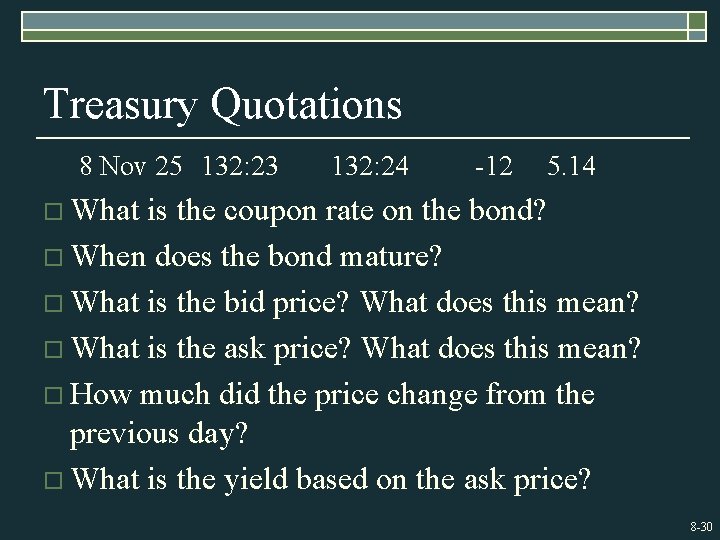

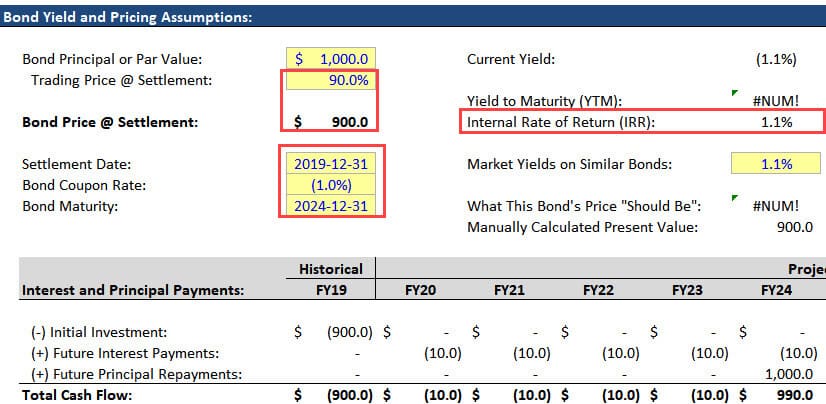

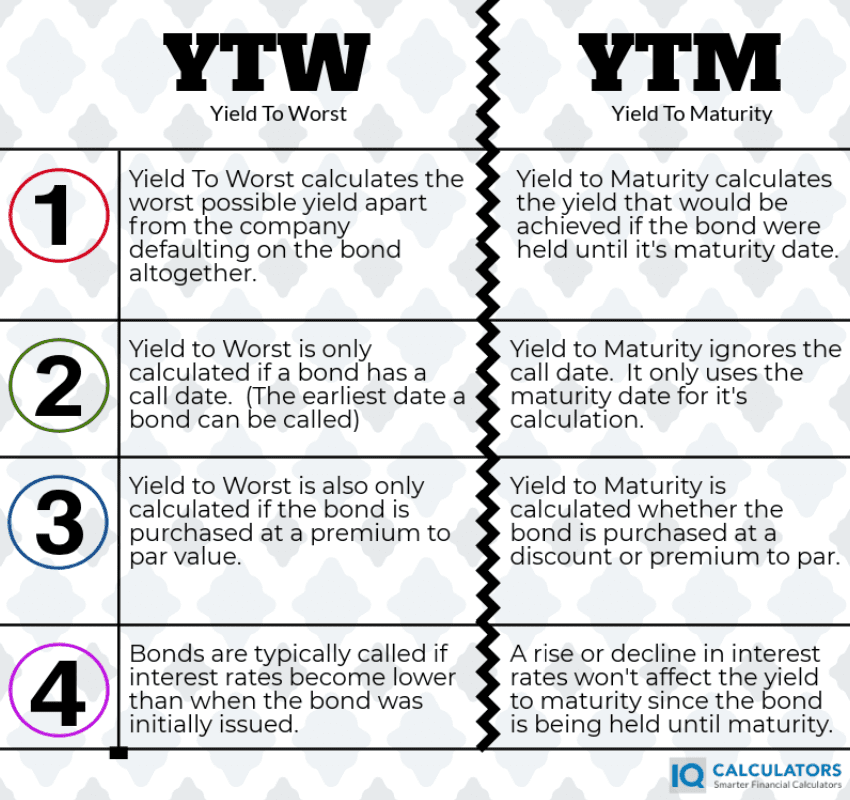

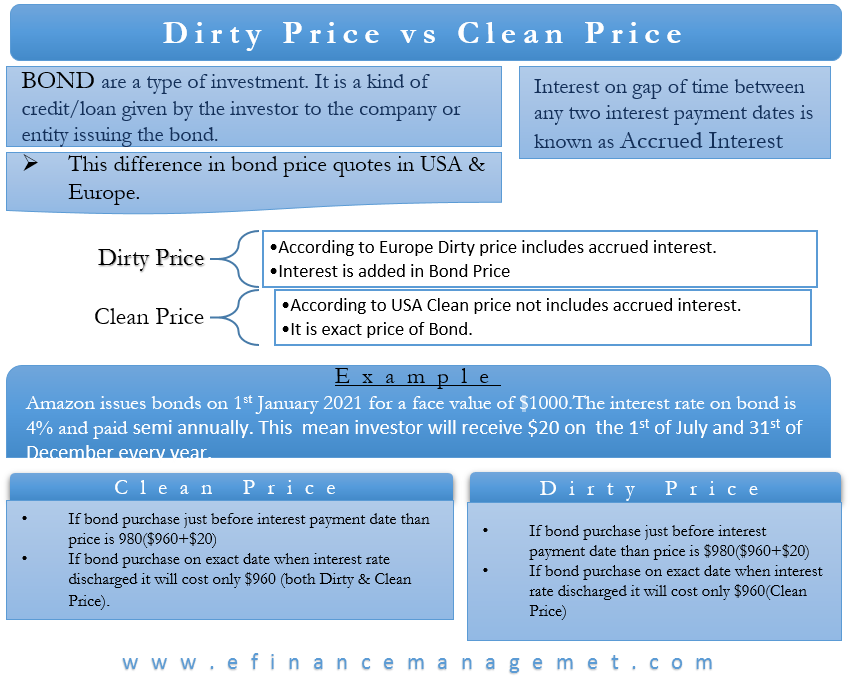

What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. Yield To Worst: What It Is And Why It's Important - IQ Calculators John wants to buy a bond that is selling in the market for $1,100. The coupon rate is 6% meaning it pays $60 in coupon payments annually. The bond is callable in 2 years but John plans to hold the bond until maturity which is in 10 years. By using a yield to maturity calculator, it is calculated that the YTM is 4.72%.

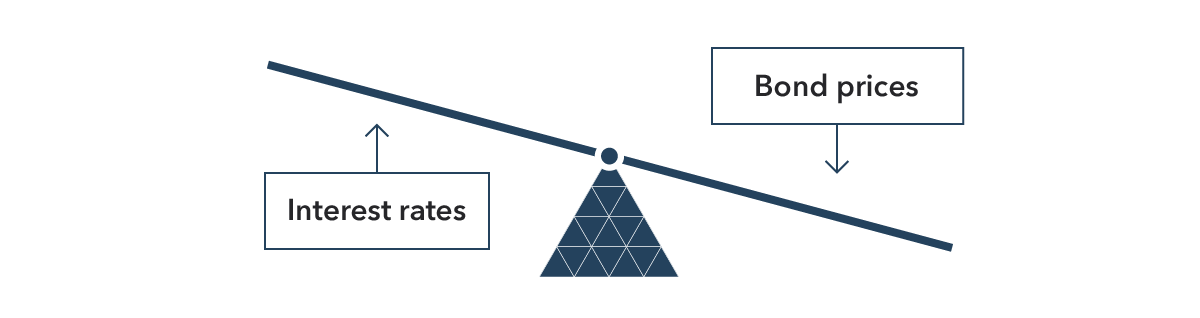

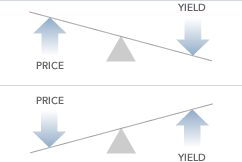

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate is the interest rate paid by a bond relative to its par or face value. For a fixed-rate bond, this will be the same for its entire maturity. Prevailing interest rates may rise or...

What does coupon rate mean

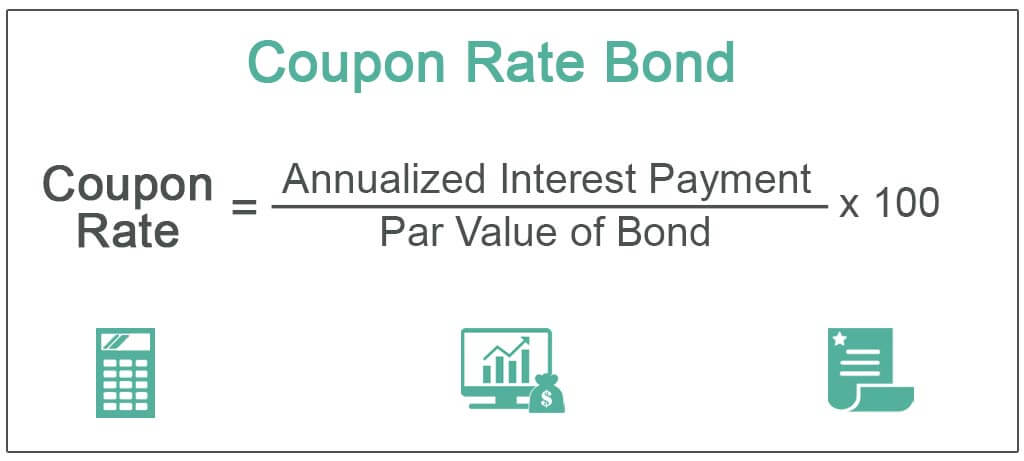

What is a Coupon? - Definition | Meaning | Example - My Accounting Course Coupon rates are set by the companies or governments that issue the bonds and can vary immensely depending on the duration of the term of the bond and/or the stability of the issuing entity. For example, a bond that has a 30-year term may have a higher rate than a 1-year note, in order to compensate the holder for having to wait longer for the ... Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward. The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of ...

What does coupon rate mean. What is a Coupon Payment? - Definition | Meaning | Example Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond. It was also used as a way to track the steady payment ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset b. The coupon rate is the fixed annual rate at which a guaranteed-income security, typically a bond, pays its holder or owner. It is based on the face value of the bond at the time of issue, otherwise known as the bond's "par value" or principal.Though the coupon rate on bonds and other securities can pay off for investors, you have to know how to calculate and evaluate this important ... Coupon-rate Definitions | What does coupon-rate mean? | Best 1 ... Meanings The coupon rate is the rate of interest that is payable on a bond yearly. This rate is determined at the time the bond is purchased and generally does not change. Basically, the higher the coupon rate, the higher the interest payments received from the bond. 0 0 Advertisement Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

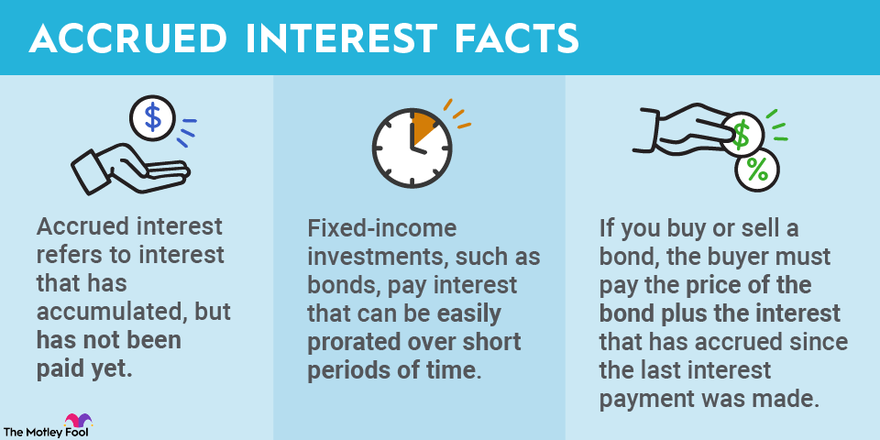

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms... Coupon Frequency Definition | Law Insider definition. Coupon Frequency means how regularly an issuer pays the coupon to holder. Bonds pay interest monthly, quarterly, semi - annually or annually. (d) Maturity date is a date in the future on which the investor 's principal will be repaid. From that date, the security ceases to exist. Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet The coupon is the annual payment(s) an investor can expect to receive on a bond, expressed as a percent of the par value, which is also known as the principal. Coupon payments are made at regular intervals, usually a year, though for Treasury notes for example, the interval is six months. Important Differences Between Coupon and Yield to Maturity - The Balance To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount that's a percentage of the original bond price. Yield to maturity is what the investor can expect to earn from the bond if they hold it until maturity. Do the Math

What Does Semiannual Mean? | Examples, Summary - Carbon Collective Example 2 - Interest rate. Interest is sometimes stated for six months. If a semi-annual interest rate of 6% is calculated per year, it would mean that the overall interest rate that you will pay is 12%. Let's look at Jane's Travel, Jane borrows $100,000 from the bank with a 6% semi-annual interest payment. To calculate the interest per ... Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence? Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond, although bonds... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

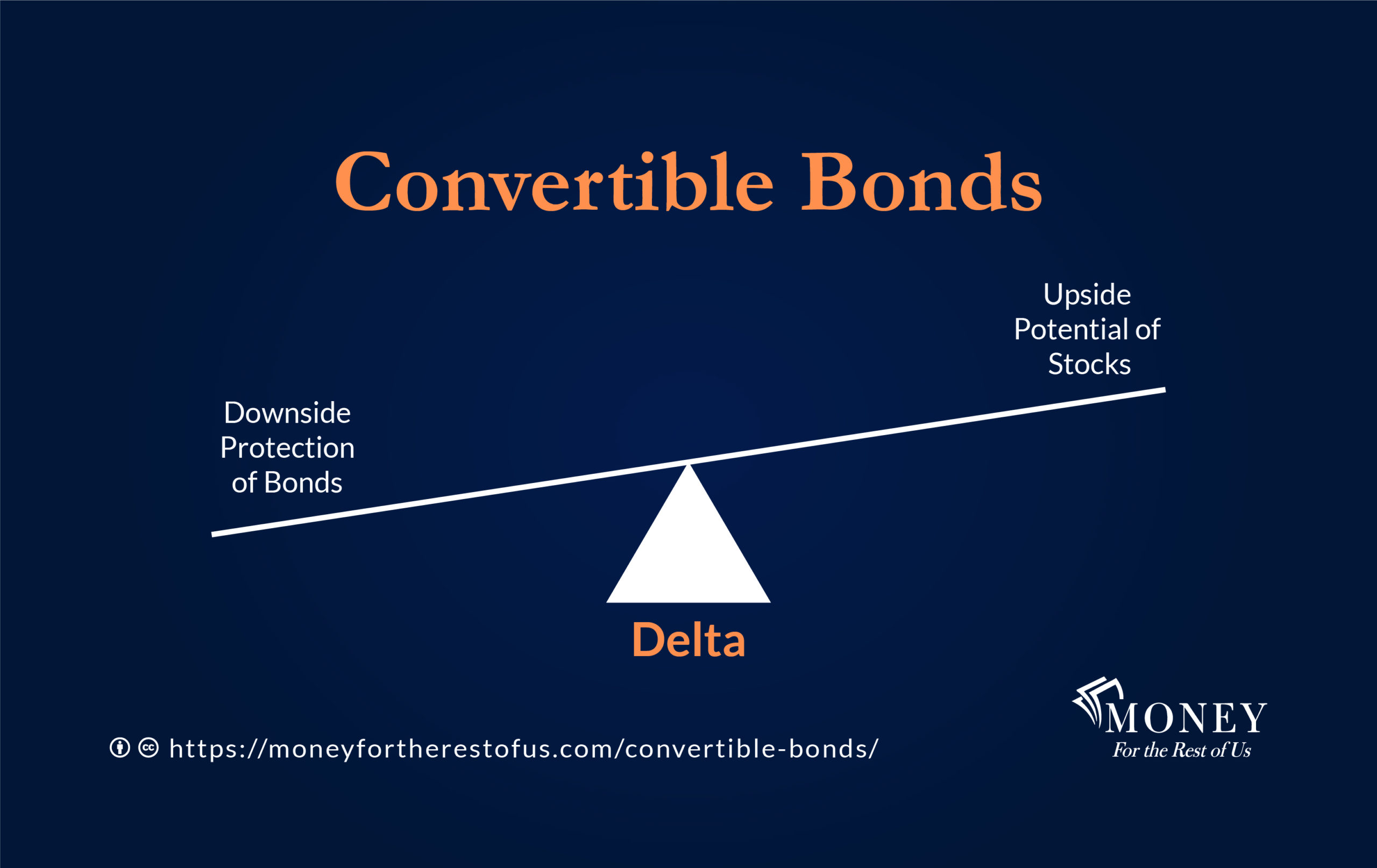

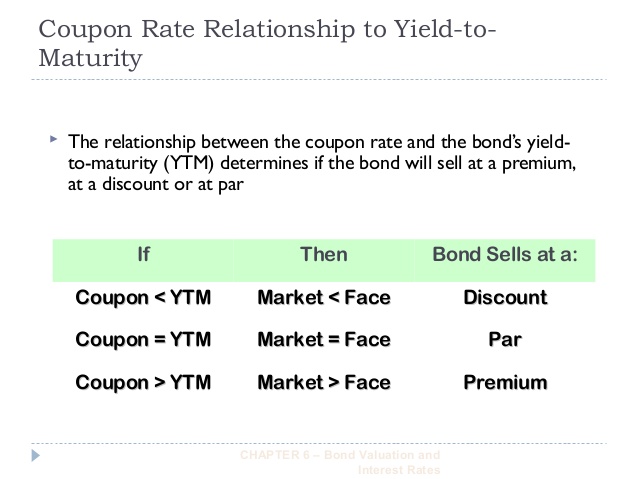

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Coupon Definition | Bankrate.com A coupon in the financial world is defined as the annual interest rate paid on a bond that is expressed as a percentage of its face value. This also can be referred to as a bond's coupon rate ...

What does Coupon Rate mean? - YouTube Marketing Business Network 13.1K subscribers The coupon rate is the annual interest rate paid on a bond. It is represented as a percentage of the bond's face value. This video provides a brief...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

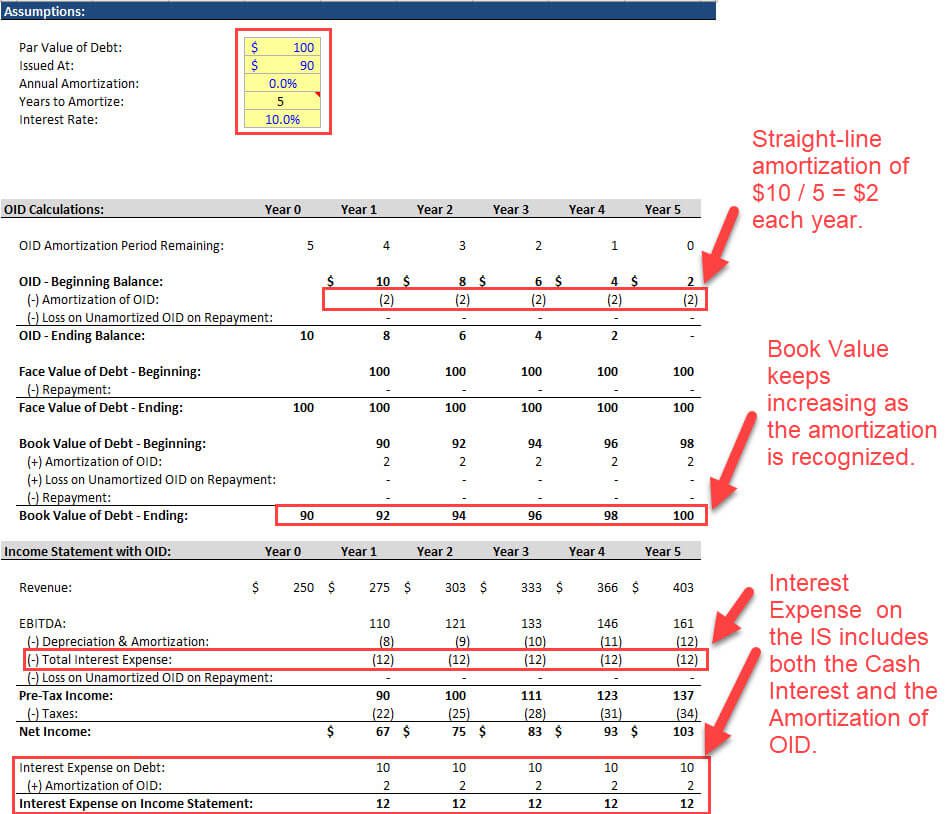

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

Coupon Bond - Guide, Examples, How Coupon Bonds Work These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields on their investment. In the past, such bonds were issued in the form of bearer certificates. This means that the physical possession of the certificate was sufficient proof of ownership.

What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals. Zero-Coupon Certificates of Deposit

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward. The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of ...

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo What is Coupon Rate? The coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more is the rate of interest being paid off for the fixed income security such as bonds.

What is a Coupon? - Definition | Meaning | Example - My Accounting Course Coupon rates are set by the companies or governments that issue the bonds and can vary immensely depending on the duration of the term of the bond and/or the stability of the issuing entity. For example, a bond that has a 30-year term may have a higher rate than a 1-year note, in order to compensate the holder for having to wait longer for the ...

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

.png)

Post a Comment for "40 what does coupon rate mean"