42 zero coupon bond face value

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia General Advantages of Zero-Coupon Bonds Why would anyone want a bond without the interest? Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000... Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

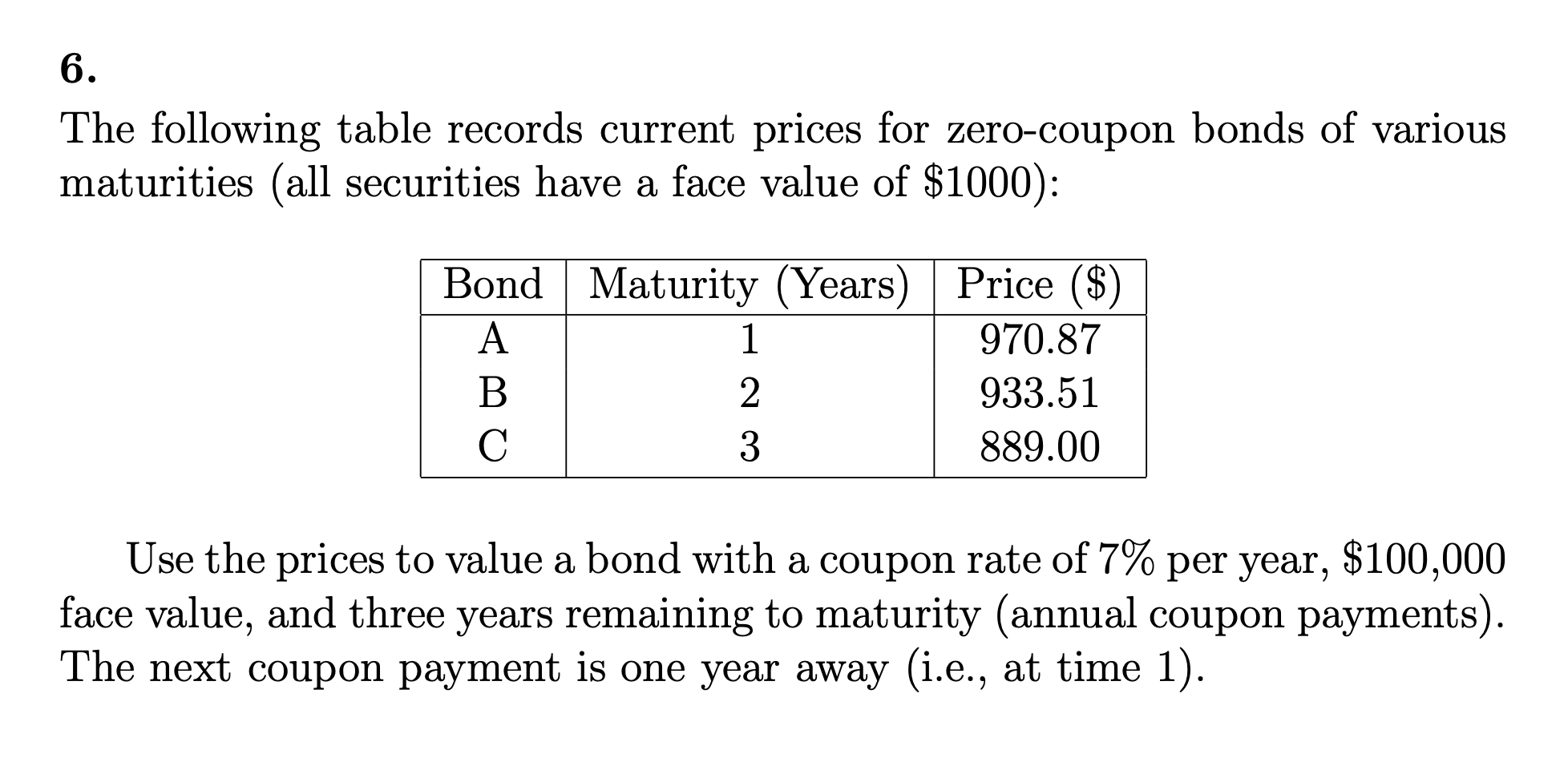

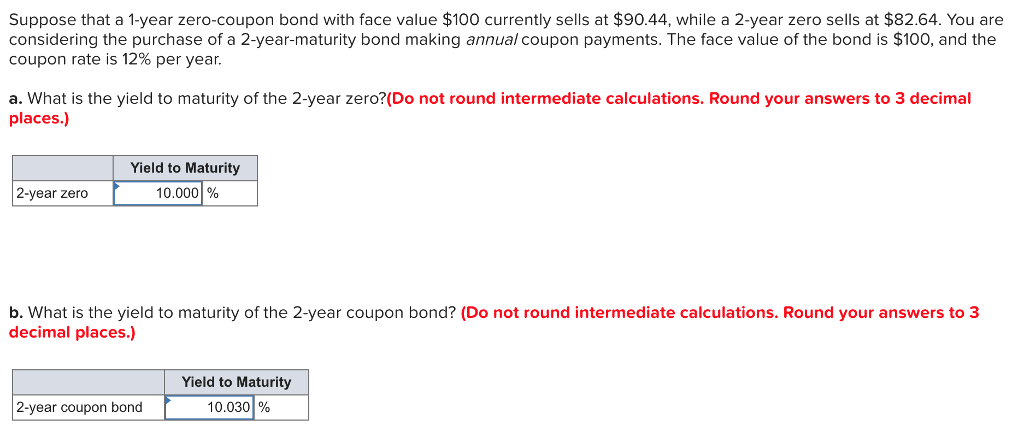

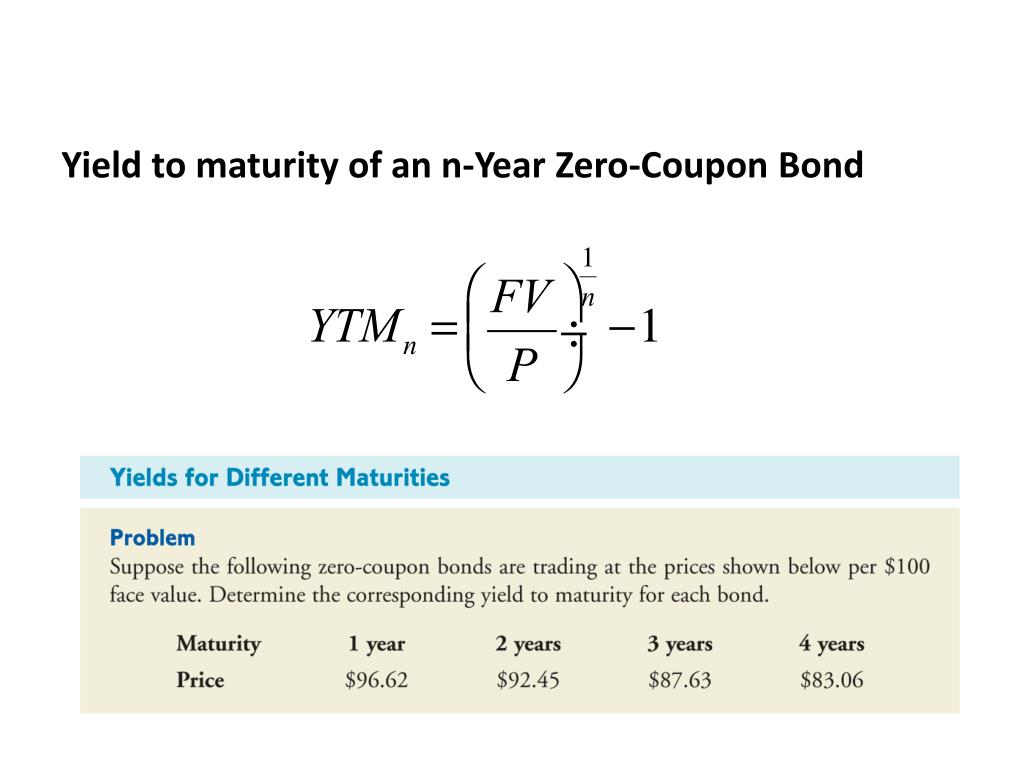

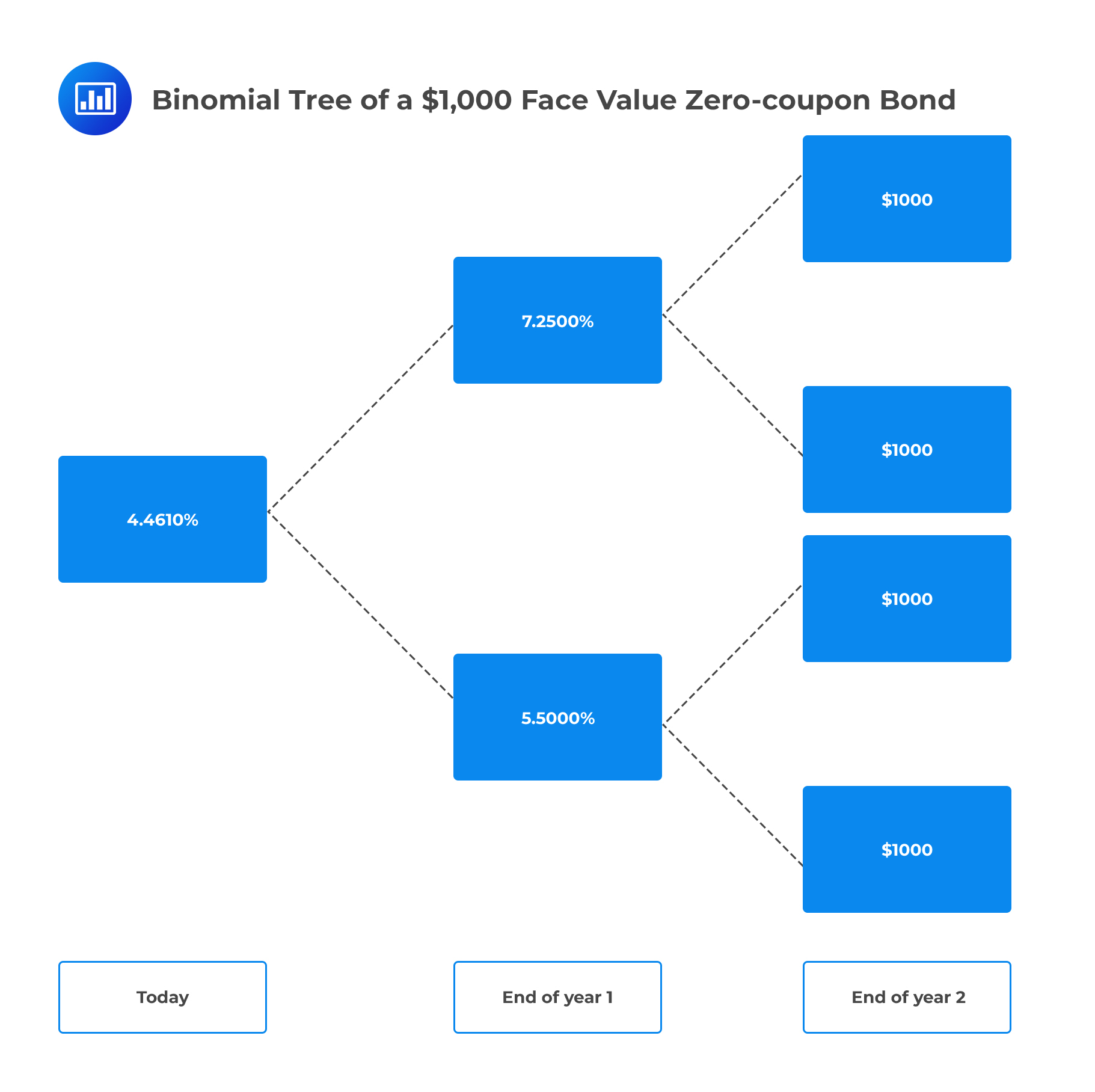

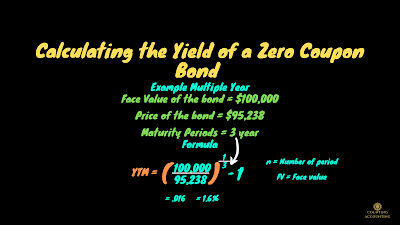

Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes

Zero coupon bond face value

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. Solved a. A zero-coupon bond has face value of $1,000 and | Chegg.com This problem has been solved! a. A zero-coupon bond has face value of $1,000 and time to maturity of 4.1 years. If it is currently trading for $913, what is this zero-coupon bond's yield-to-maturity? Round to the hundredth of a percent. (e.g., 4.32% =4.32) b. A 7-year zero-coupon bond has a face value of $1,000. Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Zero coupon bond face value. Answered: Suppose that a default-risk-free… | bartleby Homework help starts here! Business Finance Q&A Library Suppose that a default-risk-free zero-coupon bond with a face value of $100 and 5 years to maturity is currently trading at $60. Another bond with the same face value and time to maturity but at risk of defaulting sells for $30. (If this risky bond defaults, there is a 70% chance that 30% ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. Solved A zero-coupon bond has face value of $1,000 and time | Chegg.com You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer A zero-coupon bond has face value of $1,000 and time to maturity of 5.9 years. If it is currently trading for $872, what is this zero-coupon bond's yield-to-maturity? Round to the hundredth of a percent. (e.g., 4.32% =4.32) Expert Answer Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows:... Solved A zero-coupon bond with face value $1,000 and | Chegg.com A zero-coupon bond with face value $1,000 and maturity of four years sells for $740.22. a. What is its yield to maturity? (Round your answer to 2 decimal places.) Yield to maturity % b. For the accrued interest - qsjr.starfits.de A discount from the face value of a bond occurs when investors want to earn a higher rate of interest than the rate paid by the bond, so they pay less. ... For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. Solved 1. Consider a zero-coupon bond with face value of | Chegg.com 1. Consider a zero-coupon bond with face value of $100, 3-year term, and yield to maturity of 2.6%. What is this bond worth today? Round to the nearest cent (two decimal places). 2. Consider a company that issued 5,000 zero-coupon bonds with face value of $1,000 at a price of $734 each. How much did the company borrow in this bond offering? 3.

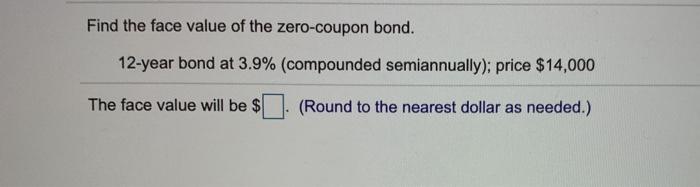

Zero Coupon Bond Calculator - MiniWebtool A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero Coupon Bond | Investor.gov Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years.

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

Solved a. A zero-coupon bond has face value of $1,000 and | Chegg.com This problem has been solved! a. A zero-coupon bond has face value of $1,000 and time to maturity of 4.1 years. If it is currently trading for $913, what is this zero-coupon bond's yield-to-maturity? Round to the hundredth of a percent. (e.g., 4.32% =4.32) b. A 7-year zero-coupon bond has a face value of $1,000.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation.

Post a Comment for "42 zero coupon bond face value"