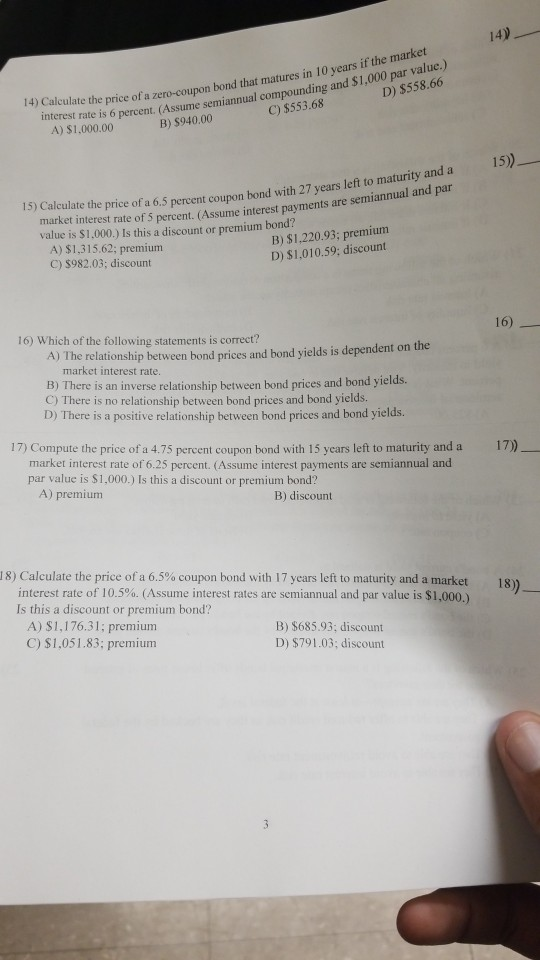

41 calculate price zero coupon bond

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ... Calculate Zero Coupon Bond Value - calculatoratoz.com To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Calculate price zero coupon bond

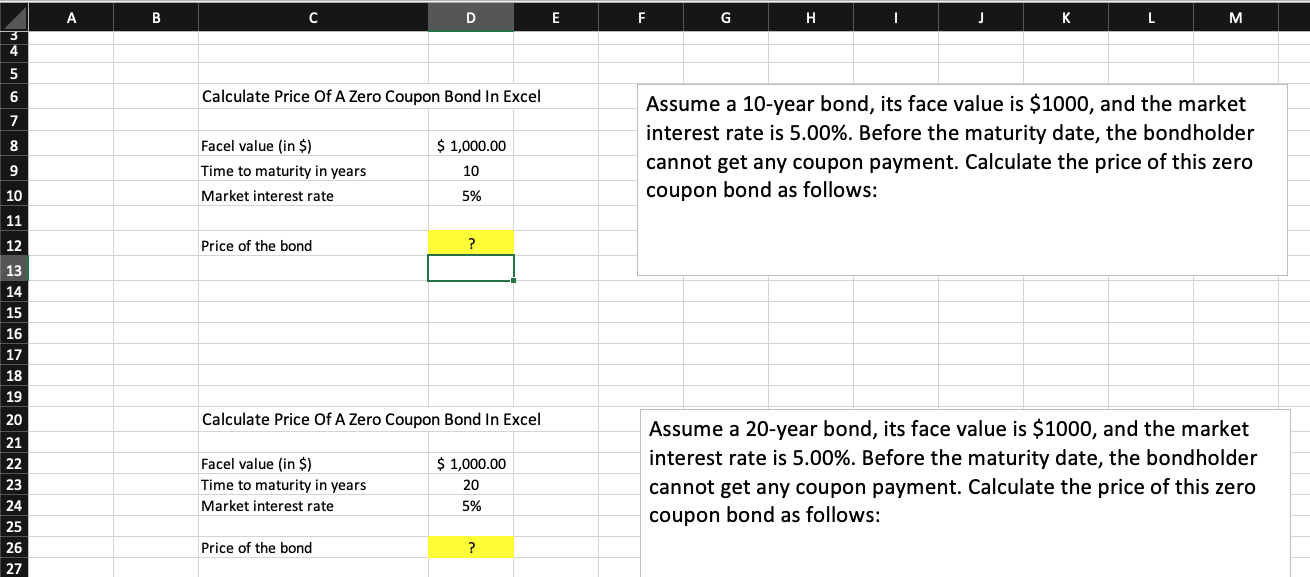

How to Calculate Bond Price in Excel (4 Simple Ways) Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples) Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. Zero Coupon Bond Value Calculator. Face Value ($): Yield (%): Years to Maturity: Value. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2.

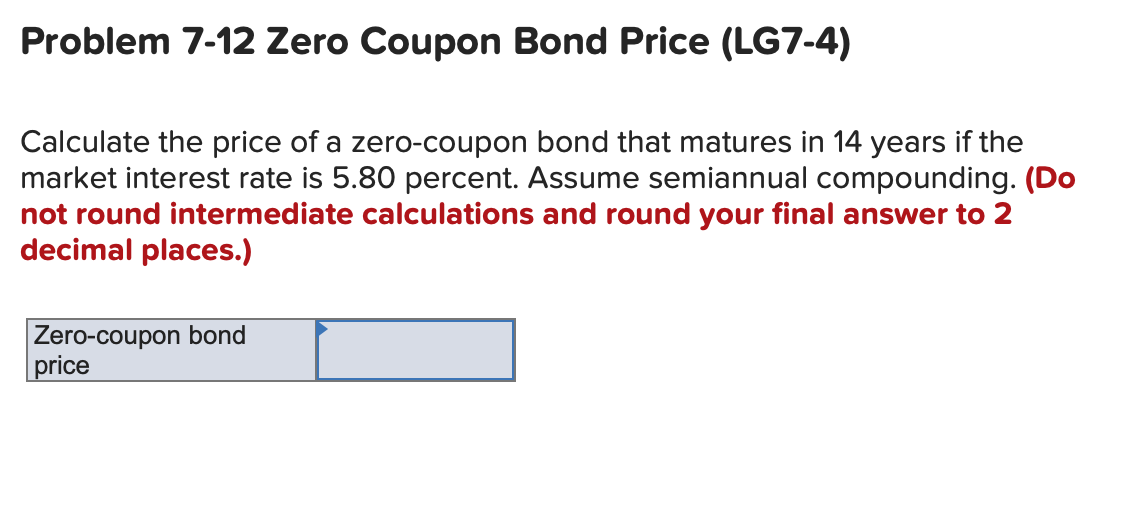

Calculate price zero coupon bond. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods. Solved Zero Coupon Bond Price Calculate the price of a zero - Chegg Finance questions and answers. Zero Coupon Bond Price Calculate the price of a zero coupon bond that matures in 9 years if the market interest rate is 8 percent. Assume semi-annual interest payments and $1,000 par value. (Round your answer to 2 decimal places.) Multiple Choice $920.00 $500.25 $493.63 $1,000.00. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the...

Zero Coupon Bond: Formula & Examples - Study.com A zero-coupon bond still has 5 years to mature and is currently priced at $760 in the capital market. Assume that the face value is $1,000 and the required interest rate of the bond is 5%... Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. How to Calculate the Price of a Zero Coupon Bond To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures. Bond Convexity Calculator - Estimate a Bond's Price ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

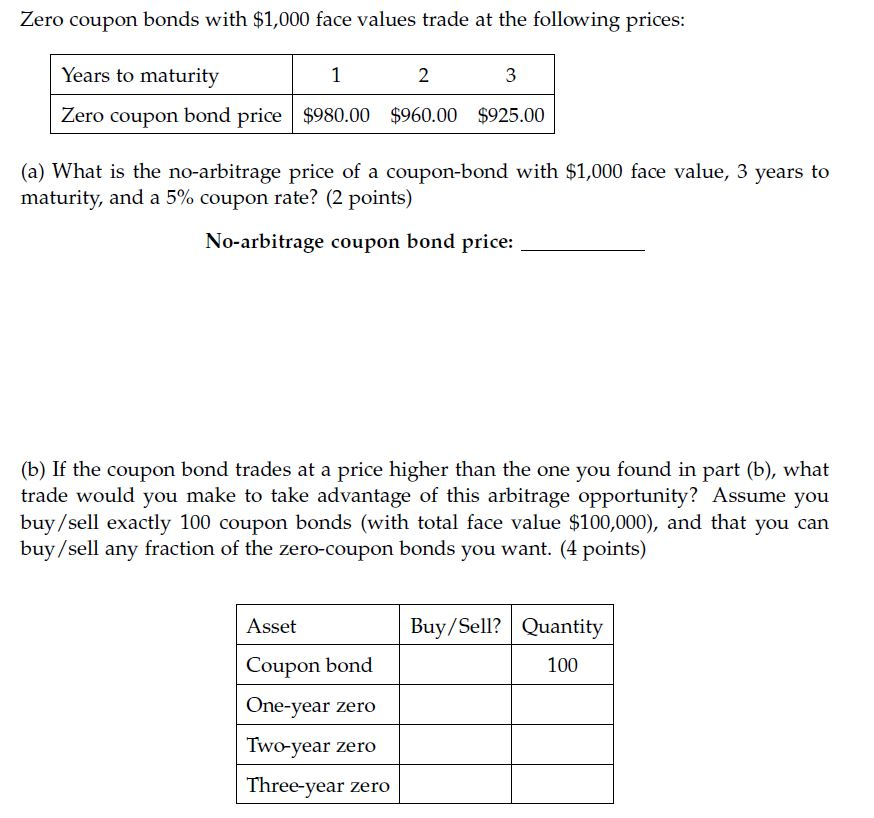

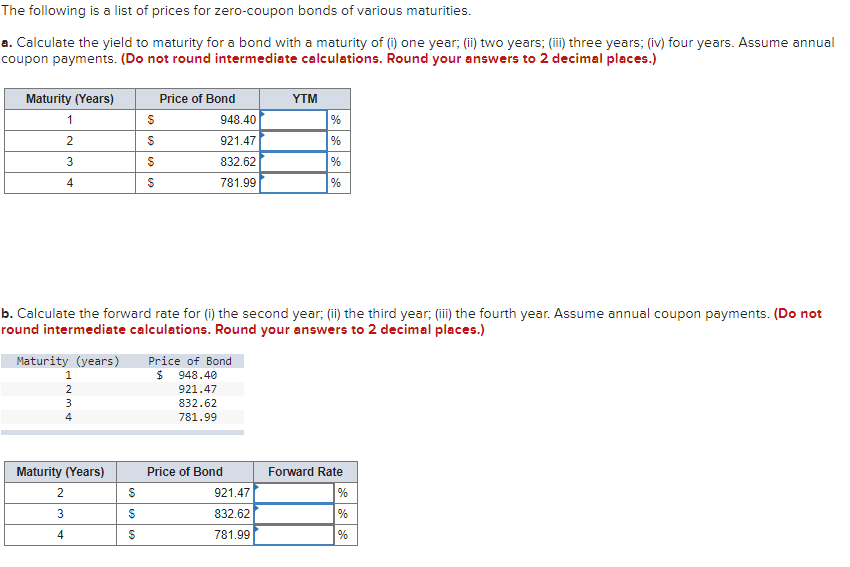

How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get any coupon as below screenshot shown. You can calculate the price of this zero coupon bond as follows: Zero Coupon Bond Value Formula: How to Calculate Value of Zero Coupon Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity. PRICE Function - Formula, Examples, How to Price a Bond Example 1. Suppose we wish to calculate the price per $100 face value of a bond purchased on April 1, 2017. The maturity date of the bond is March 31, 2025. The rate of interest is 9.5%. The yield is 8% and the redemption value is $100. The US (NASD) 30/360 day count basis is used and payments are made semi-annually. Calculate Price of Bond using Spot Rates | CFA Level 1 - AnalystPrep Sometimes, these are also called "zero rates" and bond price or value is referred to as the "no-arbitrage value." Calculating the Price of a Bond Using Spot Rates. Suppose that: the 1-year spot rate is 3%; the 2-year spot rate is 4%; and; the 3-year spot rate is 5%. The price of a 100-par value 3-year bond paying 6% annual coupon ...

Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity. Job Finder - Search for Jobs Hiring. Summation (Sum) Calculator. Percent Off Calculator - Calculate Percentage.

Solved Calculate the price of a zero-coupon bond that | Chegg.com Expert Answer. Price of the bond = $377.55 (Approx) Step 1: Informa …. View the full answer. Calculate the price of a zero-coupon bond that matures in 24 years if the market interest rate is 4.1 percent. Assume semiar compounding.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Therefore, calculation of the Coupon Bond will be as follows, So it will be - = $838.79 Therefore, each bond will be priced at $838.79 and said to be traded at a discount ( bond price lower than par value) because the coupon rate is lower than the YTM. XYZ Ltd will be able to raise $4,193,950 (= 5,000 * $838.79). Example #2

2 Calculate the current yield to maturity on the zero coupon bond that ... Bond B - the cash coupon paid by this bond is C = 8% × 1,000 = 80 €. The bond price with a yield to maturity of 10% is: B 0 = 80 × 1 − (1 + 10%) − 30 10% + 1,000 (1 + 10%) 30 = 811.46 € 3.2.Determine which bond is selling at discount and which is selling at a premium. Bond A's current price is higher than its par value. Bond A trades at a premium. This happens when the coupon ...

Zero Coupon Bond Calculator - Nerd Counter Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Then, the under the given procedure will be applied to get the required answer easily: $2000 (1+.2)10;

Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. Zero Coupon Bond Value Calculator. Face Value ($): Yield (%): Years to Maturity: Value. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

How to Calculate Bond Price in Excel (4 Simple Ways) Also, using the conventional formula you can find the zero-coupon bond price. Zero-coupon bond price means the coupon rate is 0%. Type the following formula in cell C11. = (C5/ (1 + (C8/C7))^ (C7*C6)) Press the ENTER key to display the zero-coupon bond price. Read More: How to Calculate Coupon Rate in Excel (3 Ideal Examples)

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 calculate price zero coupon bond"