41 formula for coupon payment

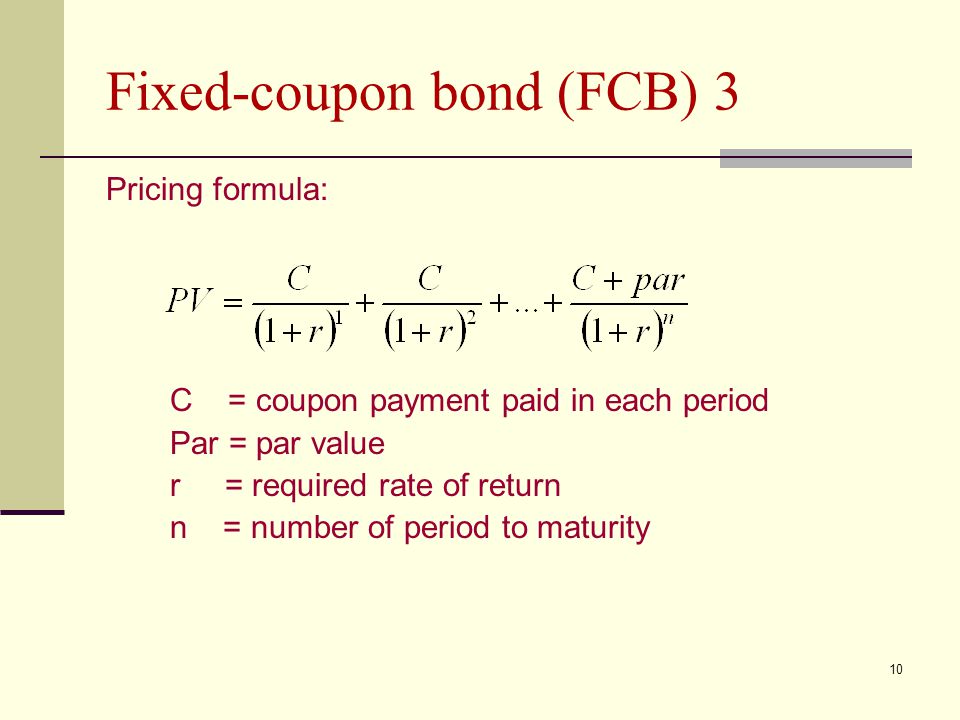

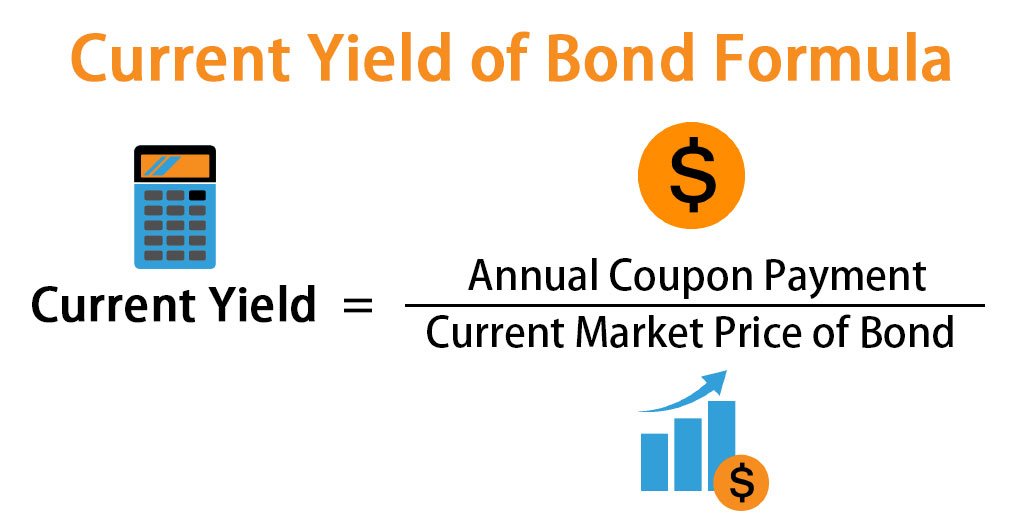

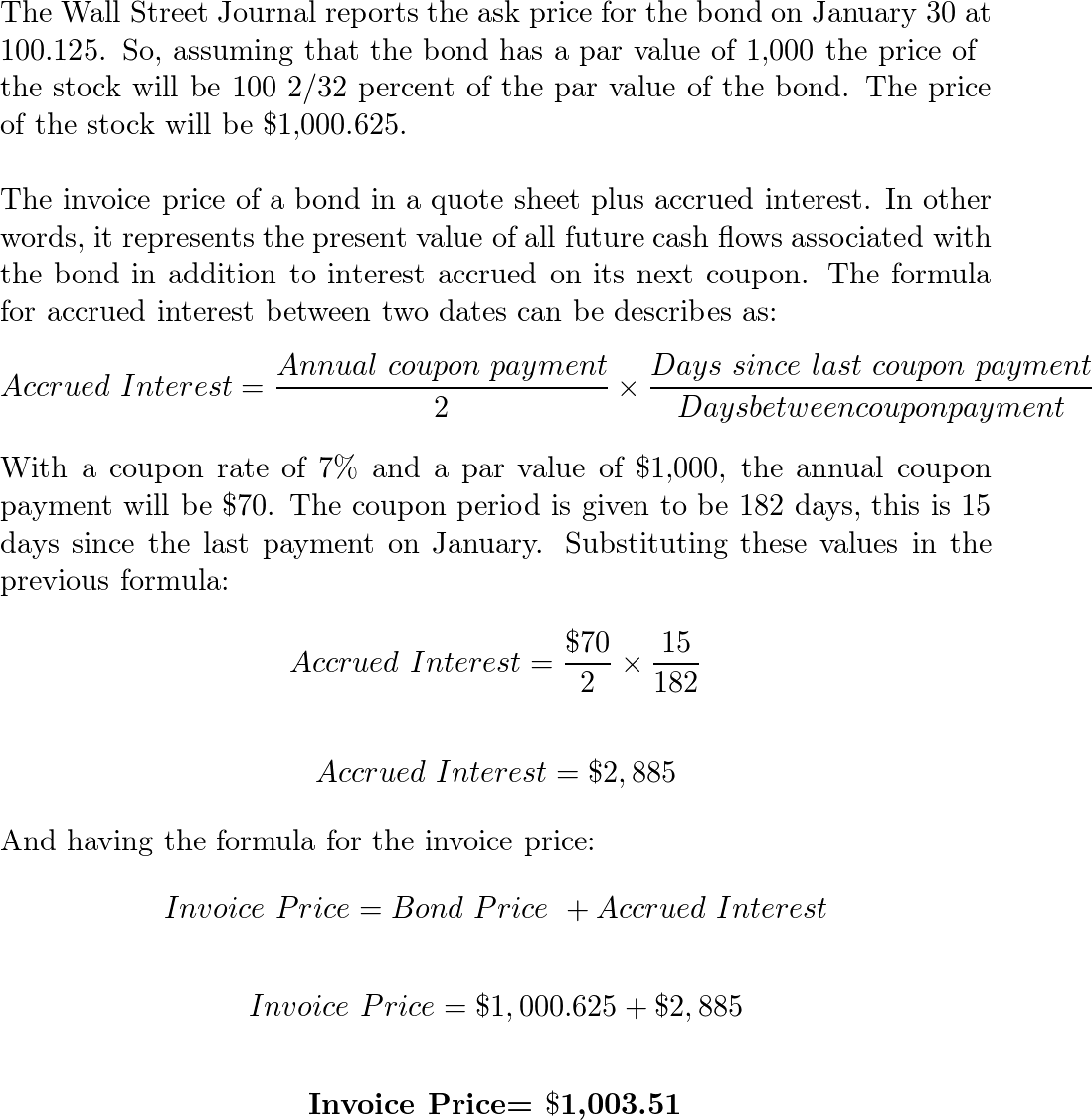

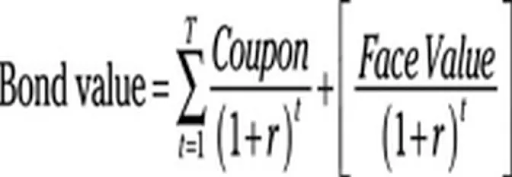

What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par ... Bond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ...

Coupon Bond Formula | Examples with Excel Template - eduCBA Coupon Bond Formula ; Formula; Examples ; C = 5% * $1000; C = $50 ; Coupon Bond = $50 * [1 – (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) · Coupon Bond = $932 ; C =(5%/2) ...

Formula for coupon payment

Watch Formula 1 Online 2022 | F1 Live Streaming | F1 Full ... Formula 1 Online has made possible to watch all F1 live racing competitions in high-definition on multiple smart gadgets around the planet. It does not require to buy something extra or pay heavy pay-per-view fees, just need a finest internet connection and one-time subscription fee, which is less and affordable. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. U.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · From payment apps to budgeting and investing tools and alternative credit options, fintech makes it easier for consumers to pay for their purchases and build better financial habits. Nearly half of fintech users say their finances are better due to fintech and save more than $50 a month on interest and fees.

Formula for coupon payment. Coupon Payment | Definition, Formula, Calculator & Example Apr 27, 2019 · A change in coupon rate means a change in coupon payment. For example, a bond may have coupon rate equal to LIBOR + 3%. Since LIBOR is variable, the coupon rate and coupon payments are variable too for this bond. In deferred coupon bonds, initial coupon payments are deferred for a certain period while in accelerated coupon bonds, the coupon ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years. Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a ... How to Calculate a Coupon Payment: 7 Steps (with Pictures) Calculating the Coupon Payment ... Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon ...

What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon payment refers to the annual interest paid on a bond between its issue date and the date of maturity. · The coupon rate is determined by adding the sum ... Coupon Payment Calculator Jul 8, 2022 ... How to find the coupon payment? · Divide the annual coupon rate by the number of payments per year. For instance, if the bond pays semiannually, ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond’s par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond.

Coupon Rate Formula & Calculation - Video & Lesson Transcript Apr 8, 2022 ... Coupon Rate Formula · Identify the par value of the bond. · Identify the frequency of periodic payments (or coupon payments) that have been made. U.S. appeals court says CFPB funding is unconstitutional ... Oct 20, 2022 · From payment apps to budgeting and investing tools and alternative credit options, fintech makes it easier for consumers to pay for their purchases and build better financial habits. Nearly half of fintech users say their finances are better due to fintech and save more than $50 a month on interest and fees. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. Watch Formula 1 Online 2022 | F1 Live Streaming | F1 Full ... Formula 1 Online has made possible to watch all F1 live racing competitions in high-definition on multiple smart gadgets around the planet. It does not require to buy something extra or pay heavy pay-per-view fees, just need a finest internet connection and one-time subscription fee, which is less and affordable.

Post a Comment for "41 formula for coupon payment"