43 coupon interest rate definition

Learn About Coupon Interest Rates | Chegg.com Coupon interest rate is fixed by the issuer of bond at the time of issue of bond. It is expressed in percentage terms. Overview of Coupon Interest Rates As defined above, the coupon interest rate is defined as the nominal or ostensible yield to be paid by the issuer on the bond which was decided on its date of issue. Coupon rate financial definition of Coupon rate - TheFreeDictionary.com The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

What is coupon rate | Definition and Meaning | Capital.com A coupon rate is a yield that is paid out for a fixed-income security such as a government and corporate bond. A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value.

Coupon interest rate definition

Coupon Rate: Definition, Formula & Calculation - Study.com Coupon rate, as used in fixed-income investing, refers to the annualized interest with respect to the initial loan amount. Learn the definition of and formula for coupon rate, and understand the ... › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ... Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ...

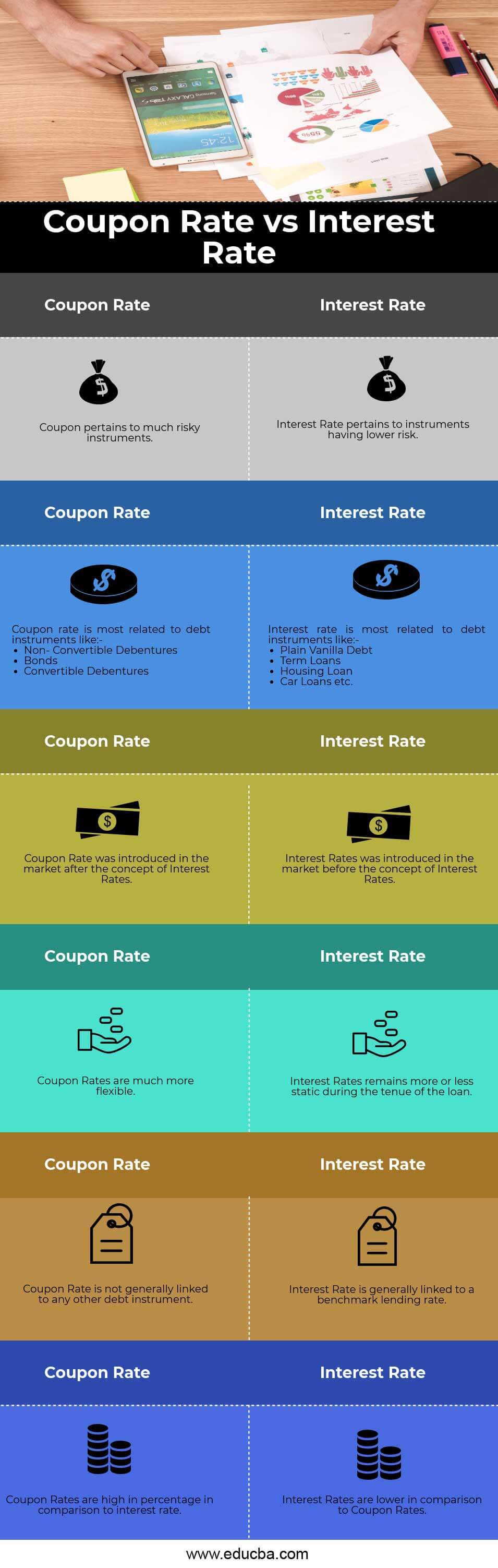

Coupon interest rate definition. Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are … Difference Between Coupon Rate and Interest Rate A coupon rate is an annual interest payment, which is provided by the bond issuer to the bondholder at the time of maturity. In the meantime, coming to the interest rate, it is the charges put on the payment by the lender to the borrower. Coupon Rate vs Interest Rate Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income Fixed Income Fixed Income refers to those investments that pay fixed interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more securities such as bonds. Coupon Definition & Meaning - Merriam-Webster 05.07.2012 · How to use coupon in a sentence. a statement of due interest to be cut from a bearer bond when payable and presented for payment; also : the interest rate of a coupon… See the full definition

en.wikipedia.org › wiki › Interest_rateInterest rate - Wikipedia An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum).The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. What Is a Certificate of Deposit Coupon? | Pocketsense A coupon is the stated rate of interest on the certificate of deposit. The term comes from bonds that have coupons that must be torn off the original bond and redeemed to be paid the interest due. The interest rate specified by the coupon is paid at set intervals. Variable Interest Rate: Definition, Pros & Cons, Vs. Fixed 31.03.2021 · Variable Interest Rate: A variable interest rate is an interest rate on a loan or security that fluctuates over time, because it is based on an underlying benchmark interest rate or index that ... Interest Rate Risk (Definition, Types)| Interest Rate Interest rate risk is also impacted by the coupon rate. The bond with a lower coupon rate has a higher interest rate risk as compared to a bond with a higher interest rate. This is so, as a small change in the market interest rate can easily outweigh the lower coupon rate and will reduce the market price of that bond.

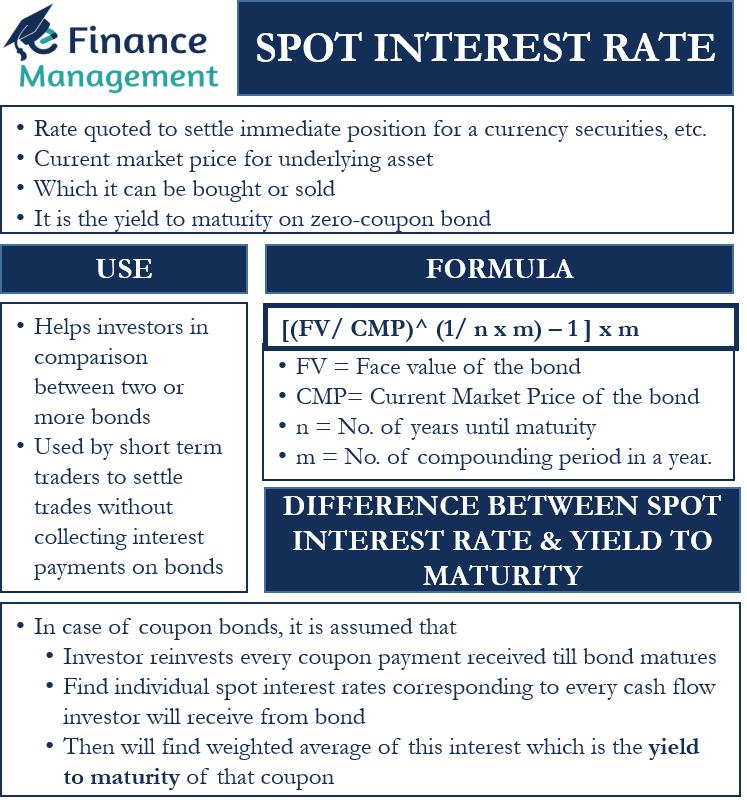

Interest rate - Wikipedia For an interest-bearing security, coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, whereas current yield is the ratio of the annual coupon divided by its current market price. Yield to maturity is a bond's expected internal rate of return, assuming it will be held to maturity, that is, the discount rate which equates all … Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... What Is the Coupon Rate of a Bond? - The Balance The coupon rate of a bond or other fixed income security is the interest rate paid out on the bond. When the government or a company issues a bond, the rate is fixed. The coupon rate is stated as an annual percentage rate based on the bond's par, or face value. The dollar amount represented by this coupon rate is paid each year—usually on a ...

› terms › cWhat Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

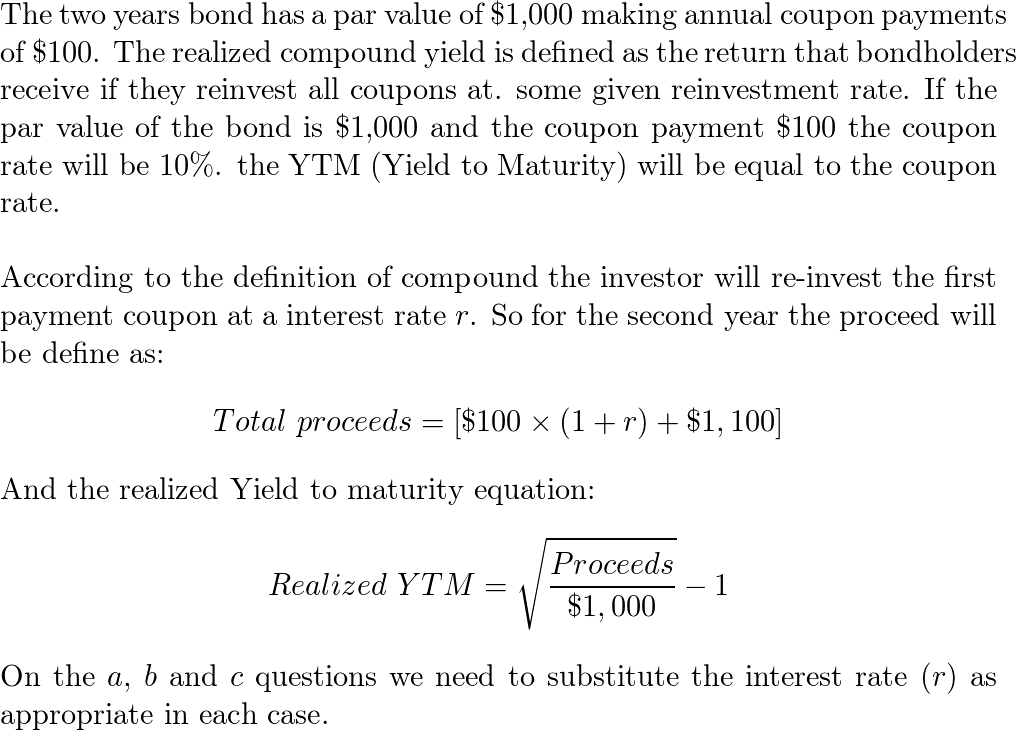

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon rate is an interest rate that the issuer agrees to pay every year on fixed income security. It is also known as the nominal rate, and it is paid every year till maturity. The method to calculate coupons is fairly straightforward. The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of ...

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

Coupon interest rate financial definition of coupon interest rate coupon interest rate the INTEREST RATE payable on the face value of a BOND. For example, a £100 bond with a 5% coupon rate of interest would generate a nominal return of £5 per year. See EFFECTIVE INTEREST RATE. Collins Dictionary of Economics, 4th ed. © C. Pass, B. Lowes, L. Davies 2005 Want to thank TFD for its existence?

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon Rate - Explained - The Business Professor, LLC To calculate the coupon rate, you first have to divide the sum of the security's yearly coupon payment. You then divide them by the par value of the bond. Example of Coupon Rate. About the Interest Rate. Coupon rate refers to the interest rate on the bond that the issuer pays throughout the bond term.

en.wikipedia.org › wiki › InterestInterest - Wikipedia In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate.

Coupon Interest Rate Definition | Law Insider Coupon Interest Rate means the interest rate(expressed as a percentageper annum), as specifiedon the Australian Government Bonds Website, payablein respect ofa specificseriesof TreasuryIndexedBonds. Sample 1Sample 2 Based on 4 documents 4 Save Copy Remove Advertising Examples of Coupon Interest Ratein a sentence

Coupon Definition & Meaning - Merriam-Webster 1 : a statement of due interest to be cut from a bearer bond when payable and presented for payment also : the interest rate of a coupon 2 : a small piece of paper that allows one to get a service or product for free or at a lower price: such as a : one of a series of attached tickets or certificates often to be detached and presented as needed b

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Coupon rate - definition and meaning - Market Business News The coupon rate is the interest rate that the issuer of a bond pays, which normally happens twice a year. The bondholder receives the interest payments during the lifetime of the bond. In other words, from its issue date until it reaches maturity. Bonds are types of debts or IOUs that companies, municipalities, or governments sell and people buy.

Interest rate derivative - Wikipedia In finance, an interest rate derivative (IRD) is a derivative whose payments are determined through calculation techniques where the underlying benchmark product is an interest rate, or set of different interest rates.There are a multitude of different interest rate indices that can be used in this definition.. IRDs are popular with all financial market participants given the need for …

home.treasury.gov › interest-rate-statisticsInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

› terms › bBond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Coupon Interest Rate: What is Coupon Interest Rate? Fixed Income ... What is Coupon Interest Rate? The Interest to be annually paid by the issuer of a bond as a percent of per value, which is specifi

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ...

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

Interest Rate Risk Definition and Impact on Bond Prices 25.09.2022 · Interest Rate Risk: The interest rate risk is the risk that an investment's value will change due to a change in the absolute level of interest rates, in the spread between two rates, in the shape ...

Difference Between Coupon Rate and Interest Rate • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender.

What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

Coupon Rate vs Interest Rate | Top 8 Best Differences ... - WallStreetMojo What is Coupon Rate? The coupon rate is the rate of interest being paid off for the fixed income security such as bonds. This interest is paid by the bond issuers where it is being calculated annually on the bonds face value, and it is being paid to the purchasers.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued. What Does Coupon Rate Mean?

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate is the interest the bond issuer pays to the bondholder on an annual basis. In other words, it is the return an investor can expect from their bond investment. This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

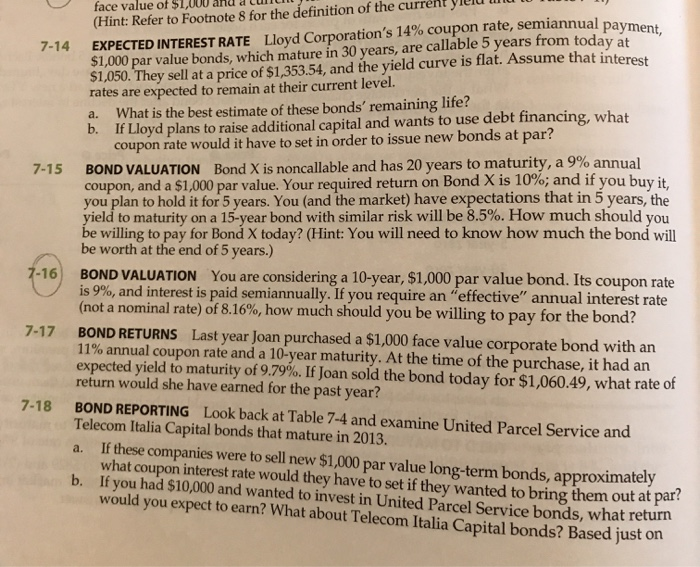

Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · The coupon rate on a bond vis-a-vis prevailing market interest rates has a large impact on how bonds are priced. If a coupon is higher than the prevailing interest rate, the bond's price rises; if ...

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower ...

Coupon Rate: Definition, Formula & Calculation - Study.com Coupon rate, as used in fixed-income investing, refers to the annualized interest with respect to the initial loan amount. Learn the definition of and formula for coupon rate, and understand the ...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

:max_bytes(150000):strip_icc()/interest-rates-1d0e17952d9949b1bab273e830855f90.png)

:max_bytes(150000):strip_icc()/simpleinterest_final-b7d28549fe554817b45621890b909dac.png)

Post a Comment for "43 coupon interest rate definition"