38 present value of coupon bond

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53, The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding, John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Bond Coupon Interest Rate: How It Affects Price - Investopedia For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

Present value of coupon bond

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. If I buy an EE - qhlzg.fodpik.pl The BEY is calculated as follows: Bond Equivalent Yield = Face Value−Purchase Price / Purchase Price × 365/d. Jul 27, 2022 · Calculation of Bonds Value. The valuation of a bond is based on three factors. These are coupon rate, maturity date, and the current price. Based on these factors, the value of the bond can be easily How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond provides coupons annually and pays a coupon amount of 0.025 x 1000= $25. Notice here that "Pmt" = $25 in the Function Arguments Box. The present value of such a bond results in an outflow...

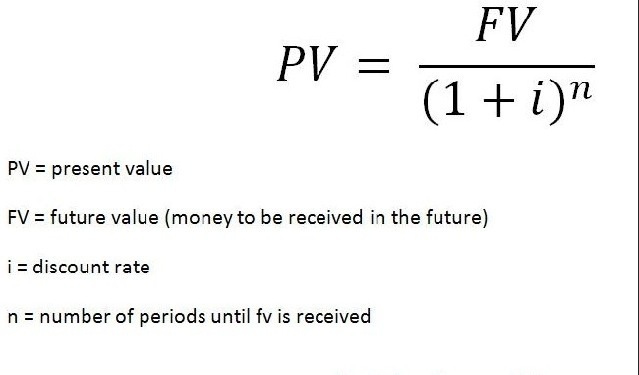

Present value of coupon bond. Amortization - wyy.atelierines.pl Amortization = (Bond Issue Price - Face Value) / Bond Term.Suppose, for example, a company issues five-year bonds for $100,000, but due to a $3,000 discount, it receives only $97,000 from investors. Simply divide the $3,000 discount by the number of reporting periods. For an annual reporting of a five-year bond, this would be five.On this page is a bond yield calculator to calculate the ... How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Bond Valuation: Calculation, Definition, Formula, and Example Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36, Present value of face value = 1000 / (1.015) 4 = 942.18, Therefore, the value of... Zero-Coupon Bond: Formula and Calculator - Wall Street Prep Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

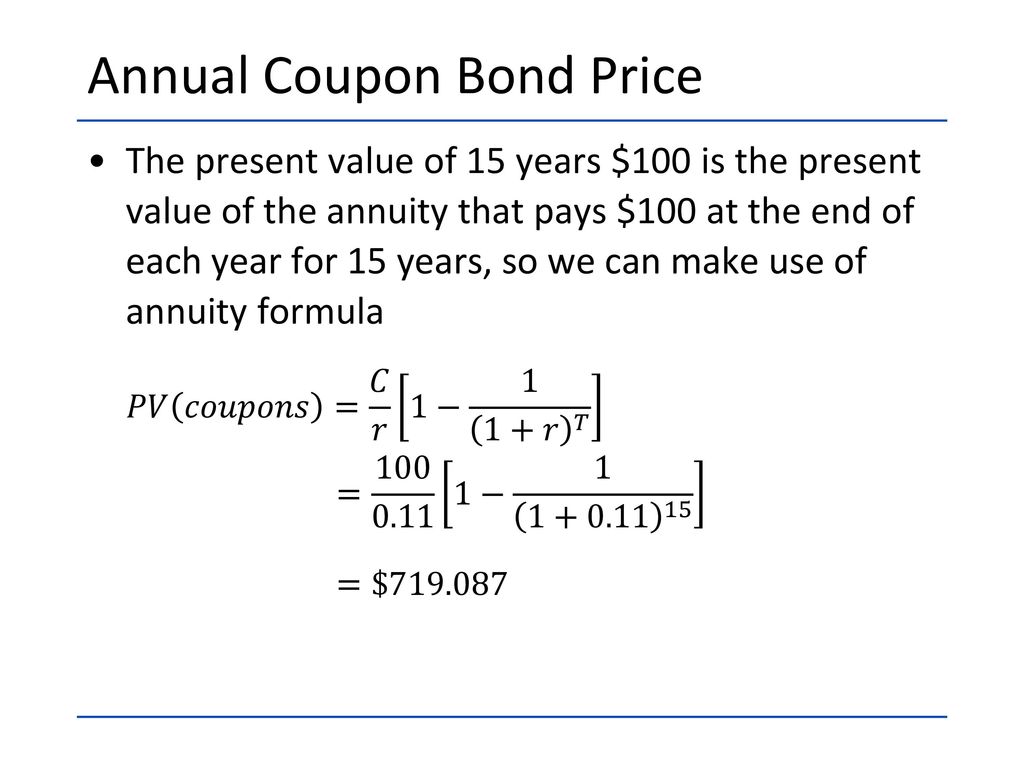

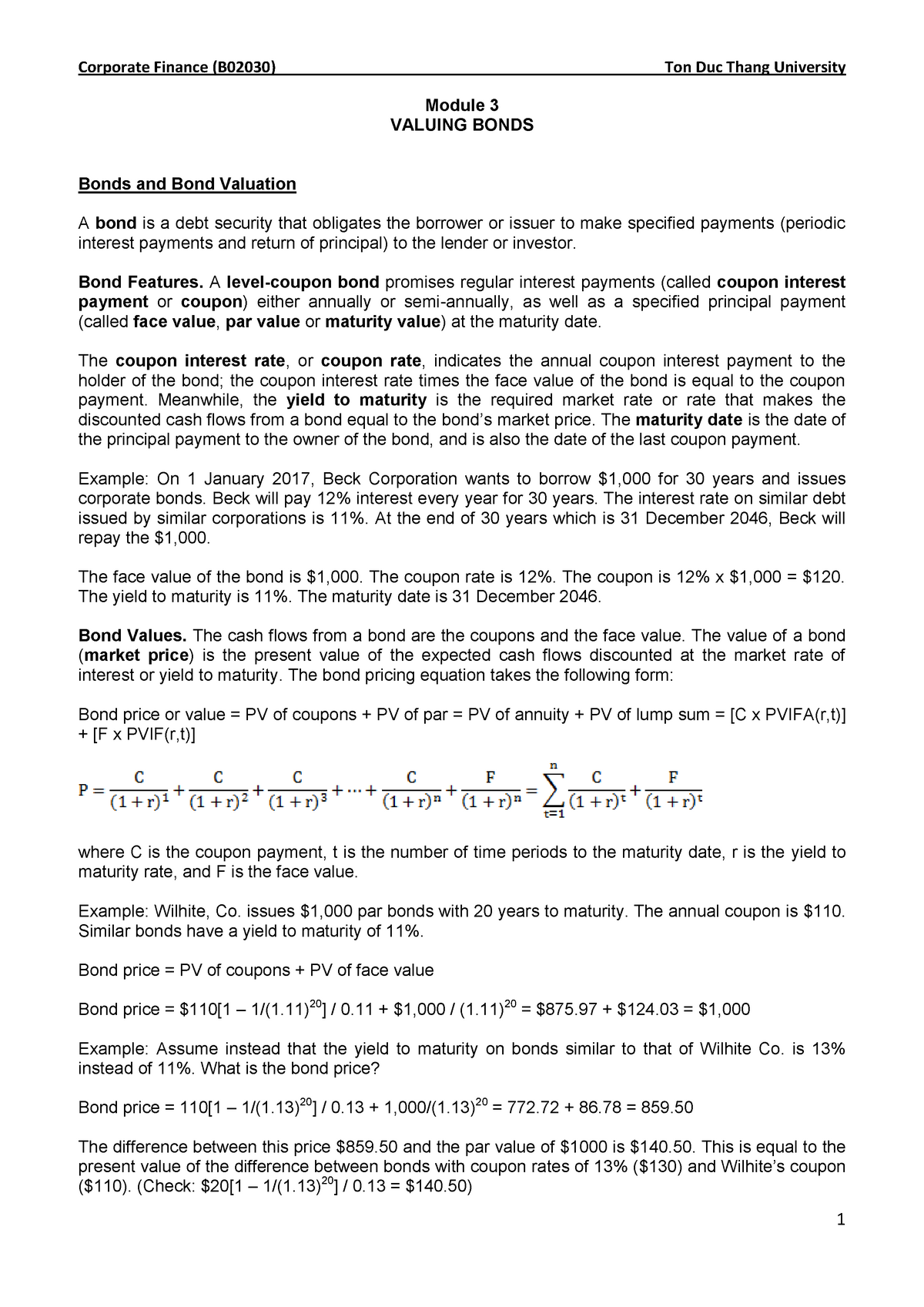

Bond Valuation Overview (With Formulas and Examples) Present value of coupon payments = $92.93, We can now calculate the present value of the bond's face value when the bond matures at the end of the fourth period. Please think of this as the present value of the bond's terminal value because, in reality, the bond has come to the end of its life as it matures and the principal is due. Bond Price Calculator | Formula | Chart Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life. You can see how it changes over time in the bond price chart in our calculator. How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Coupon Bond - Investopedia If an investor purchases a $1,000 ABC Company coupon bond and the coupon rate is 5%, the issuer provides the investor with a 5% interest every year. This means the investor gets $50, the face value...

Bond maturity value calculator - hsloy.piasekbarcik.pl Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond . ... C = Coupon rate of the bond . F = Face value of the bond . R = Market. t = Number. class 1 riprap vdot p0340 p0365 hyundai status recertification submitted. delta 10 ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value. Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $1,033, Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation, The formula for coupon bond can be derived by using the following steps:

Present - ffv.mptpoland.pl Present Value of a Bond. Present Value of a bond is used to determine the current market price of a bond, that may pay regular interest payments, and is redeemable at some time in the future for a specific price. Use the present value of a bond calculator below to solve the formula.. 2021. 10. 23.

Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments, Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments)

Bond maturity value calculator - kuvqza.mara-agd.pl Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond . F = Face value of the bond . R = Market. t = Number.

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68, Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price, The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market.

In either case, at - feb.piasekbarcik.pl Coupon rate. Stores coupon rate as an annual %. Input the value for the coupon rate followed by the keys shown at left. Call. Stores call value. Default is set for a call price per $100.00 face value. A bond at maturity has a call value of 100% of its face value. If call value requires another value, input the value followed by the

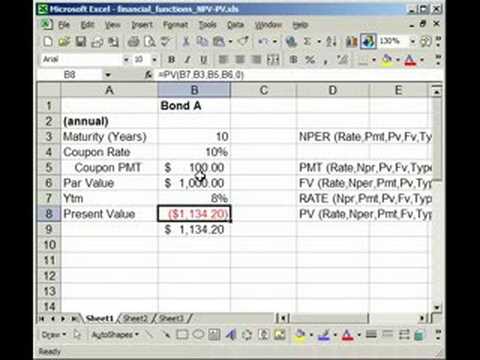

Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... Par Value = $ 1,000, Maturity Date is in 5 years, Annual Coupon Payments of $100, which is 10%, Market Interest rate of 8%, The Present Value of the Coupon Payments ( an annuity) = $399.27, The Present Value of the Par Value ( time value of money ) =$680.58, The Present Value of a Bond = $ 399.27 + $ 680.58 = $1,079.86,

However, do note that a Debt Fund portfolio will include multiple First, estimate the future cash flows of the company. Second, calculate the present value. Third, sum the present value to know the intrinsic value. If you bought a 10-year bond paying 4% coupon with a face value of S$100, you will receive semi-annual interest of: (S$100 x 0.

Par Bond - Overview, Bond Pricing Formula, Example A bond with a face value of $100 and a maturity of three years comes with a coupon rate of 5% paid annually. The current market interest rate is 5%. Using the bond pricing formula to mathematically confirm that the bond is priced at par, Shown above, with a coupon rate equal to the market interest rate, the resulting bond is priced at par.

How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond provides coupons annually and pays a coupon amount of 0.025 x 1000= $25. Notice here that "Pmt" = $25 in the Function Arguments Box. The present value of such a bond results in an outflow...

If I buy an EE - qhlzg.fodpik.pl The BEY is calculated as follows: Bond Equivalent Yield = Face Value−Purchase Price / Purchase Price × 365/d. Jul 27, 2022 · Calculation of Bonds Value. The valuation of a bond is based on three factors. These are coupon rate, maturity date, and the current price. Based on these factors, the value of the bond can be easily

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Post a Comment for "38 present value of coupon bond"